New Tax Break for Seniors

Part of the recently passed tax bill includes what the administration is calling “No Tax on Social Security.” The bill does not directly remove taxes on Social Security payments, but it does provide an additional deduction for seniors under certain income limits. This provision may effectively reduce – or, in some cases, even eliminate – federal taxes paid by people ages 65+.

First of all, it should be noted that this tax break worsens the tenuous fiscal condition of Social Security. Social Security actuaries estimate that the new tax provisions will move up the trust fund depletion date by roughly six months – from the 3rd quarter to the 1st quarter of 2034.

Nevertheless, current beneficiaries will see the benefits of lower taxes. This blog post looks at how the new deduction works and how it may impact your federal income taxes.

How Deductions Work

To understand the mechanics of this new tax break, it helps to know how deductions work. The following is a simplified explanation of the standard deduction (this is not tax advice).

You start with gross income, which is the total of all sources of taxable income. This amount typically includes work income, most pensions, taxable investment income, and up to 85 percent of your Social Security income. The taxable share of your Social Security is based on what is called “combined income,” which equals half of your Social Security benefit, plus nontaxable interest, plus all other taxable income. Once combined income is greater than $44,000 for married couples filing jointly or greater than $34,000 for single filers, 85 percent of Social Security benefits are taxable. (At lower thresholds, people are taxed on up to 50 percent of their benefit income; below these thresholds, benefits are not taxed at all.)

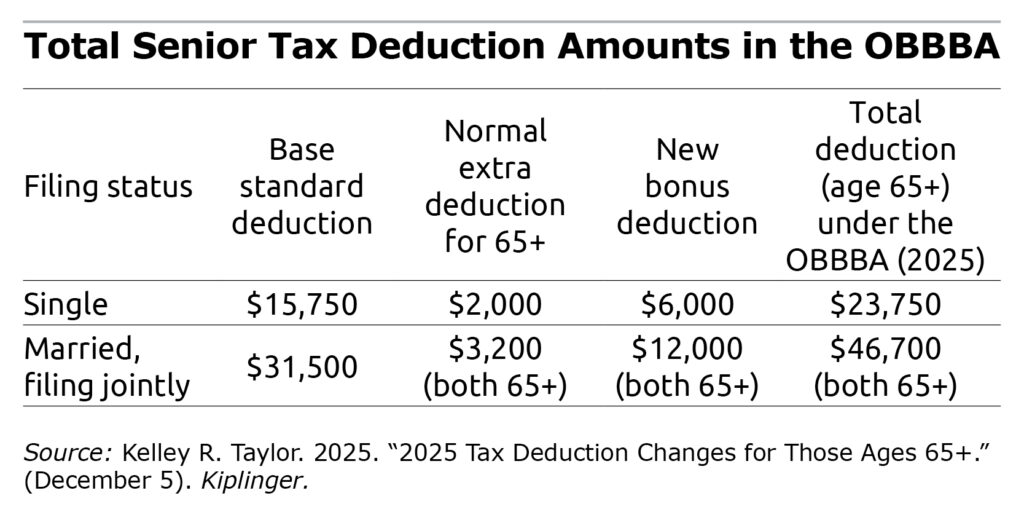

After totaling your gross income, including taxable Social Security, you subtract deductions. You have the option of tallying up individual items and itemizing deductions, but most people do better by taking the standard deduction. People ages 65+ also receive an extra standard deduction. The new tax bill adds to this already increased standard deduction, bringing the total to $23,750 for singles and up to $46,700 for married couples filing jointly (see Table). It is worth noting that this new deduction is temporary – it is available from 2025 through 2028. This potentially whopping standard deduction is then subtracted from gross income to arrive at taxable income.

Impact of the New Provision

The new provision doesn’t explicitly remove federal taxes on Social Security, but it does have the same effect for many people, reducing taxable income by $6,000 per person for those ages 65+. For lower-income retirees who are reliant on Social Security, this might be enough to all but eliminate their entire federal income tax liability. Note, though, that lower-income households below certain thresholds were already untaxed on Social Security. For these households, the additional deduction will reduce other taxable income.

Let’s look at how this might impact income taxes. Take a single woman over age 65. Say she receives a taxable pension of $30,000, investment income of $10,000, and Social Security benefits of $24,000 (85 percent of which is taxable). That puts her in the 12-percent federal tax bracket. Incorporating the new $6,000 tax provision will effectively reduce her federal tax bill by $720.

Pay Attention to Income

An important caveat to this new provision is that it is phased out for single taxpayers with incomes over $75,000 and married filers with incomes over $150,000. The phaseout is $60 for each $1,000 over the threshold. It is fully phased out at $175,000 for single filers and $250,000 for joint filers.

Bigger Refunds in 2026

Although the new tax provision does not explicitly eliminate taxes on Social Security, it will reduce taxes for many filers age 65+. If you’ve paid estimated taxes throughout the year or had taxes withheld on your income, you may end up getting a bigger refund (or owe less) in 2026.

Luke Delorme, CFP® is Director of Financial Planning at Tableaux Wealth in Great Barrington, MA (www.tableauxwealth.com), reachable at luke@tableauxwealth.com. To stay current on the Squared Away blog, join our free email list.

This blog post is for informational and educational purposes only and should not be considered financial advice. Consult a qualified professional for advice specific to your situation.

I would appreciate an explanation of how/why a reduction in Income Tax would impact the Social Security trust fund’s status. I must be missing a connection. I thought the Social Security trust fund was fed only by the taxes that we used to call FICA taxes.

Agreed. The author even states the new tax provisions will move up the trust fund depletion date by roughly six months 8 years from now. I don’t think that is a material observation worth mentioning.

Add to it for 2026 for taxpayers that file a joint return that don’t itemize, they can deduct $2,000 of their charitable contributions. As a result, retirees should be sure to use the full 12% tax bracket threshold by taking distributions from their IRA by taking advantage of the additional bonus deductions on top of their standard deduction.

The blog started by saying that the tax break would worsen the trust fund shortfall but didn’t explain why. So here goes. The trust fund gets the difference between tax payable including and excluding social security benefits. The expanded deduction lowers tax rates and reduces the additional tax collected by including social security benefits in taxable income

This is a very clear explanation of how the new deduction actually functions. While the $6,000 reduction is a significant relief for many seniors, the potential impact on the Social Security trust fund’s depletion date is a sobering trade-off. For those in the 65+ cohort who are still healthy and considering staying in the workforce, these tax savings might change the calculation of how much they need to earn to maintain their standard of living. It highlights the importance of professional financial planning as retirees navigate the balance between tax breaks, part-time work, and preserving their long-term benefits. Thank you for breaking down the phase-out thresholds so clearly.

The branding here feels a bit deceptive. Calling it “No Tax on Social Security” implies a total exemption, but it is really just a standard deduction bump. The part that actually worries me is the trust fund depletion date. Trading a few years of lower taxes now for an earlier insolvency date in 2034 seems like a pretty shortsighted move.

What is non taxable income.

Just finishing our taxes and the SS deduction reduced our tax bill by 200 dollars.

Congress just can’t bring themselves to remove a segment of the population from the controlling iron fist of the government. You seem to allow deductions instead of removal of the tax gives them the ability to still hold your income for ransom if you don’t behave. They just couldn’t let go. The solution to this is to end elected politicians retirement and medical program so they return to the same world that their general population are forced to live in.

Congress needs to feel what the American people feel by having to get the same health insurance and pensions we get. Then they will make better decisions when voting on these items.

I would like to know the rationale behind excluding those of us who are married filing separately.

My question is the same as Dawn.

Why in the world was it decided that the senior special deduction for 2025 not be eligible if you file married filing separately. What difference does it make. Give

each person the single dollar deduction. That’s the way it should be. Denying over 5 million taxpayers of this deduction is a crime on seniors.

There are many low income seniors who have only SS as income and don’t pay any tax as it is. These are the people who REALLY need financial help and this does nothing for them.

If your combined income exceeds $150,000, as was explained to me, the $60 per $1,000 reduction is applied to both individuals’ deduc g ion on a joint return. So instead of deducting 6% of the amount over $150,000, you actually reduce the $12,000 deduction by 12% of the amount over $150,000. Seems to me to be a double penalty. Big issue if doing Roth conversions for example.

Exactly form is designed for only one spouse above 65 not both

What happens to SS after 2034?

Do I put the new higher standard deduction amount on line 12e or not? Not clear!!!

Why don’t our congress start now and pass a bill to add to social security fund instead of always waiting to the last minute. All the money given away and stolen could help our seniors

To those not aware we who retired not out of choice but because our company closed and jobs were hard to find this started around 2003, for myself 2009; I found part time work till 2012, then full-time. From that date to present I have paid into social security and Medicare. One time I received a small increase in my social security, also I continued to have Medicare part B deducted from my social security. So please tell me where is all the money already paid in and being paid in on top of all of those who died in 2020 and 2021 due to covid who never collected full benefits.

How about anyone over 80 with no earned income doesn’t have to pay any taxes and doesn’t have to fill out all the tax forms. Make it easy on the elderly – trying to keep up with all the tax changes each year and actually filling out the forms is really difficult for the most elderly.