Once Again Politicians Suggest that Public Plans Divest

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The proposal, aimed at protecting Israel, suffers all the flaws of earlier divestiture efforts.

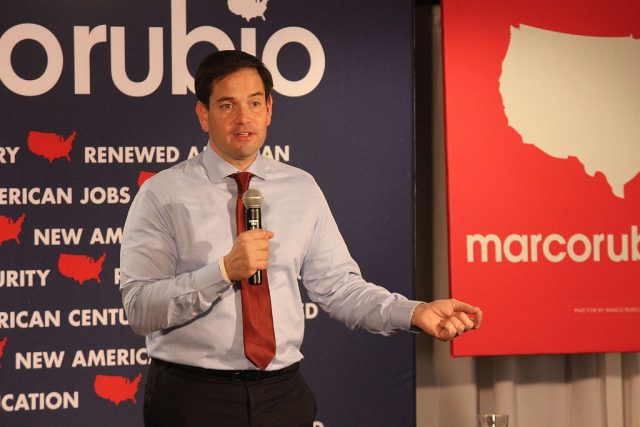

The most recent effort to engage public pension plans in social investing came in legislation sponsored by Senator Marco Rubio (R-FL), which recently passed the Senate. The relevant section (402) of S.1), a broader bill focusing on U.S. policy in the Middle East, was titled:

“NONPREEMPTION OF MEASURES BY STATE AND LOCAL GOVERNMENTS TO DIVEST FROM ENTITIES THAT ENGAGE IN CERTAIN BOYCOTT, DIVESTMENT, OR SANCTIONS ACTIVITIES TARGETING ISRAEL…”

What this section says is that states and localities have the right to prohibit investment in, divest the stocks of, and restrict contracting with any entity that advocates for sanctions and a boycott of Israel. The legislation was in response to the “boycott, divestment, and sanctions” (BDS) movement that aims to end Israel’s occupation of the Palestinian territories. Apparently more than 25 states have already adopted similar laws, and the federal legislation was aimed at extending the right to the remaining states.

The immediate criticism of the legislation centered on the issue of free speech, but my concern is that politicians are once again using public pension funds to accomplish policy goals. Social investing has a long history going back to opposition in the 1980s against South Africa’s apartheid regime, perennial efforts to divest from tobacco, moves to divest Sudan-linked stocks in 2004 after the genocide, and more recent opposition to gun manufacturers, Iran, and fossil fuels.

Many of these issues have enormous emotional appeal, but strong arguments exist against using public pension plans to accomplish policy goals, much less simply to make us feel better. It should be noted that the issue of divesture does not arise in the private sector, which is covered by the Employee Retirement Income Security Act (ERISA) of 1974. From the beginning, the U.S. Department of Labor has warned that the exclusion of investment options would be very hard to defend under ERISA’s prudence and loyalty tests. Thus, ERISA fiduciary law has effectively constrained social investing in private sector defined benefit plans.

Public pension funds are particularly ill-suited vehicles for social investing. First, adding a new criterion to the investment decision will increase the likelihood of lower returns. While the investment teams for many large public funds are first rate, others are much less experienced. Introducing divestment requirements into such an environment will take the manager’s eye off the prize – maximum returns for any given level of risk.

Second, while restricting investments for any single cause would have little impact on the returns of public pension funds, it is the first step down a slippery slope. Divesting a few stocks will have little impact on fund returns; divestiture as standard procedure will sharply increase administrative costs and lead to lower returns.

Finally, the people advocating for divestiture and the stakeholders in the pension fund are not the same people. The advocates for divestiture are either politicians or legislators. The stakeholders are tomorrow’s beneficiaries and/or taxpayers. If divestiture produces losses either through higher administrative costs or lower returns, tomorrow’s taxpayers will have to ante up or future retirees will receive lower benefits. The welfare of these future actors is not well represented in the decisionmaking process.

Just for the record, divestiture is also unlikely to have any impact on the price of the stock of the targeted companies. The action may cause a temporary price drop, but as long as some buyers remain they will swoop in, purchase the stock, and make money. And the buyers are out there. The “Vice Fund,” established in 2002, specializes in only four sectors: alcohol, tobacco, arms, and gambling, and thus stands ready to buy any stocks diverted from standard portfolios. Many public plans are not well funded, and face real challenges that need to be addressed. Advocating for divestiture is a frivolous diversion.