Private Sector Defined Benefit Plans Are Really Disappearing

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

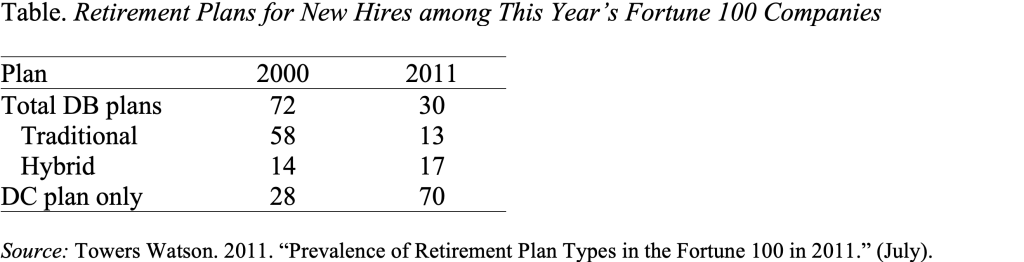

In some ways, it’s old news. Defined benefit plans in the private sector are disappearing. But the extent to which this shift has occurred in the last several years is stunning. According to Towers Watson, only 13 of this year’s Fortune 100 companies offered new employees a traditional defined benefit plan in 2011, compared to 58 in 2000.

The shift in pension coverage from defined benefit plans to 401(k)s has been underway since 1981. Originally, this shift reflected three developments: 1) the addition of 401(k) provisions to existing thrift and profit sharing plans; 2) a surge of new 401(k) plan formation in the 1980s; and 3) the virtual halt in the formation of new defined benefit plans.

Until the last 10 years, a conversion from a defined benefit plan to a 401(k) plan was an extremely rare event. The only companies closing their defined benefit pension plans were facing bankruptcy or struggling to stay alive. However, the collapse of the dot.com bubble at the turn of the century created a “perfect storm” of low equity prices, which reduced assets, and low interest rates, which increased liabilities. In the wake of that storm, healthy companies began either closing their defined benefit plan to new entrants or ending pension accruals for current as well as future employees. The 2008 financial collapse, which created a second “perfect storm” of low asset values and low interest rates, provided another push in the shift to defined contribution plans.

The pressures created by the financial markets reinforce other explanations that have been offered to explain the shift away from defined benefit plans since the turn of the century.

A Desire to Cut Compensation. Shifting from a defined benefit plan to a 401(k) plan generally will reduce required employer contributions from 7 to 8 percent of payrolls to a 3-percent employer match. The economists’ model would predict that lower pension contributions should lead to increased wages. But, however, employers shifting from a defined benefit plan to a 401(k) plan have not announced an offset of higher cash wages.

A Response to Growing Health Care Costs. Another explanation for the freezing of defined benefit plans assumes that the goal is not to cut total compensation but rather to restructure compensation in response to the enormous increase in health care costs. That is, the rapid acceleration in health care costs is driving out pension benefits.

Concern about Financial Implications of Defined Benefit Plans. Sponsors of defined benefit plans bear significant costs and risks. The employer bears the investment risk as it invests accumulated contributions over the employee’s working life; the employer bears the risk that interest rates will be very low — and therefore the price of liabilities very high; and the employer bears the risk that the retiree will live longer than projected. In addition, the employer bears the risk that accounting or legislative changes may make sponsoring a defined benefit plan more difficult.

The Evolution of a Two-Tier Pension System. The enormous divergence in pay and the emergence of non-qualified plans as the main form of pensions for upper management may have reduced the firm’s interest in the pension plan that benefits the rank and file. From the perspective of upper management, the separateness of the two systems makes it less worthwhile for the firm to absorb the costs and risks associated with providing a defined benefit plan for its employees. Interestingly, the nonqualified plans almost always take the form of a defined benefit plan based on final salary and years of service, while rank-and-file employees have increasingly been transferred into defined contribution arrangements.

There are more than enough explanations for the trend away from the traditional defined benefit plan. Given that the employer-sponsored pension system is a voluntary arrangement, nothing is likely to stop the remaining companies from following suit and closing down their defined benefit plans.