Should We Plan on Living to 100?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Probably not yet, but higher-income couples should be thinking in terms of their mid-90s.

A recent press request centered on the premise that people now have a good chance to live to 100 and what that might mean for achieving a secure retirement. I had been thinking about mortality rates and life expectancy recently, and I was skeptical whether the likelihood of living to 100 was a serious issue. Fortunately, I am surrounded with wonderful colleagues and turned to Wenliang Hou, our actuary, for an answer.

Wenliang turned to the mortality tables provided by the Social Security actuaries. For the record, the Social Security actuaries are somewhat more conservative than others in projecting mortality rates and life expectancy, so they might predict fewer people will live to 100 than some other sources. But their tables are widely used.

He based his numbers on cohort, as opposed to period, life expectancy. As an example, consider an individual who is age 65 in 2017. Under the period approach, life expectancy for this individual at later ages – 66, 67, 68, etc. – is determined simply by the years applicable to individuals currently at those ages in 2017. In contrast, a cohort approach takes into account that life expectancy for individuals will likely increase in the future. Thus, for a 65-year-old in 2017, life expectancy at 66 would be that for a 66-year-old in 2018; at 67, that for a 67-year-old in 2019, etc. Since life expectancy is projected to increase, the cohort approach produces higher life expectancy.

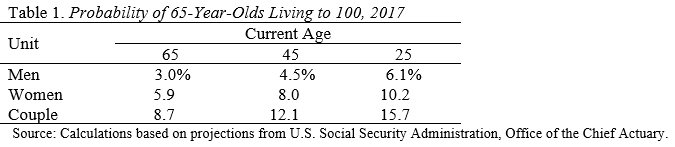

Using the Social Security data, Wenliang calculated the probability of living to 100, given that the person has survived to age 65. The results are shown in Table 1. For those who are 65 today, a man has a 3.0-percent chance of living to 100, a woman a 5.9-percent chance, and at least one member of a couple an 8.7-percent chance. These percentages rise over time, so the comparable numbers for someone age 25 today are 6.1 percent, 10.2 percent, and 15.7 percent. My conclusion is that living to 100 should not be a widespread worry at this time.

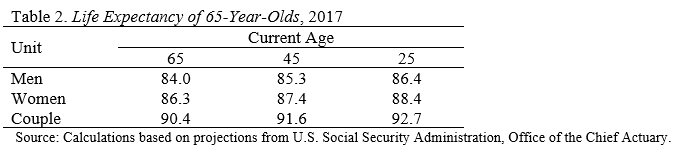

The question remains: what age should people be thinking about? To answer that question, some life expectancy information is helpful. Table 2 shows that the life expectancy for today’s 65-year-old man is 84.0, today’s woman 86.3, and for the last surviving spouse of a couple 90.4. Again, these numbers go up over time, so the comparable ages for today’s 25-year-olds are 86.4, 88.4, and 92.7.

Three considerations are relevant when thinking about what to make of these life expectancy numbers. First, they are averages. That means a large share of the population will live longer than the stated age. Second, life expectancy is strongly related to education and income, which means that those with higher incomes will almost certainly be on the high side of these ages. Third, couples should recognize that at least one of them has a good chance of surviving into the 90s.

My bottom line is that it’s too soon to be worrying about living to 100. But pointing out that many people, particularly couples and those with higher incomes, will almost certainly live into their 90s is a useful exercise.