The Case for Using Subsidies for Retirement Plans to Fix Social Security

The brief’s key findings are:

- Tax preferences for saving in retirement plans are expensive – about $185 billion in 2020, according to Treasury estimates.

- Strikingly, they also seem a bad deal for taxpayers, primarily benefiting high earners while failing to significantly boost national saving.

- Thus, the case is strong for eliminating or reducing these preferences.

- The resulting increase in tax revenues could be reallocated to fixing Social Security’s finances.

Introduction

The U.S. Treasury estimates that the tax preference for employer-sponsored retirement plans and IRAs reduced federal income taxes by about $185-$189 billion in 2020, equal to about 0.9 percent of gross domestic product.1Analysts use two different approaches for measuring tax expenditures under the federal income tax system: present value and cash flow. The Treasury has estimates for both measures: $185 billion for present value and $189 billion for cash flow in 2020. The Congressional Budget Office has a present value estimate of $202 billion (0.9 percent of GDP) for 2019, and the Joint Committee on Taxation has a cash flow estimate of $292 billion (1.4 percent of GDP) for 2020. As discussed below, revenue losses from tax expenditure policies also extend to federal payroll taxes; the CBO estimated that this amount was $74 billion in 2019. However, the best evidence suggests that the federal tax preferences do little to increase retirement saving.

While this dismal assessment may sound like bad news, it actually offers policymakers an opportunity to strengthen the nation’s retirement income system. Revenues saved from repealing the retirement saving tax preferences could be reallocated to address the majority of Social Security’s long-term funding gap.

This brief, which is based on a recent paper, reassesses the favorable tax treatment of retirement plans and explores an opportunity to use taxpayer resources more productively.2Biggs, Munnell, and Wicklein (2024). The first section addresses the revenue loss, considering the impact not only on the personal income tax but also the payroll tax, concluding that the revenues forgone are significant. The second section examines who receives these tax expenditures, concluding that the bulk goes to high earners. The third section explores what taxpayers get for their money, finding that the favorable tax treatment has failed to significantly increase national saving. The fourth section explores ways to recoup all or some of the tax subsidies. The fifth section explores how the savings from eliminating or reducing the tax subsidies could be applied to Social Security.

The final section concludes that it makes little sense to throw more and more taxpayer money at employer plans and IRAs. In fact, the case is strong for eliminating the current tax expenditures on retirement plans, and using the increase in tax revenues to address Social Security’s long-term financing shortfall.

Current Tax Treatment of Retirement Plans

The tax expenditures, under the personal income tax, arise because employees can defer taxes on compensation that they receive in the form of retirement savings. In traditional defined contribution (DC) plans, employees are not taxed either on their own or their employer’s contributions in the current year or on the investment earnings on their balances. Instead, participants are allowed to defer taxes until benefits are received in retirement, at which time both contributions and investment earnings are taxed as ordinary income. Similarly, participants in traditional defined benefit (DB) pensions are not taxed on the annual increase in the value of their accrued benefits but rather defer paying taxes until they receive benefits in retirement. Relative to saving through an ordinary investment account, the tax treatment for employer-sponsored retirement plans significantly reduces the lifetime taxes of participating employees.

This favorable treatment of retirement saving results in lower tax revenues. Historically, the federal government estimated the lost revenue on a cash basis. In 2020, this approach produced a revenue loss of $189 billion. While the cash-flow approach is meaningful for permanent deductions and exclusions, it does not correctly account for tax concessions when tax payments are deferred.

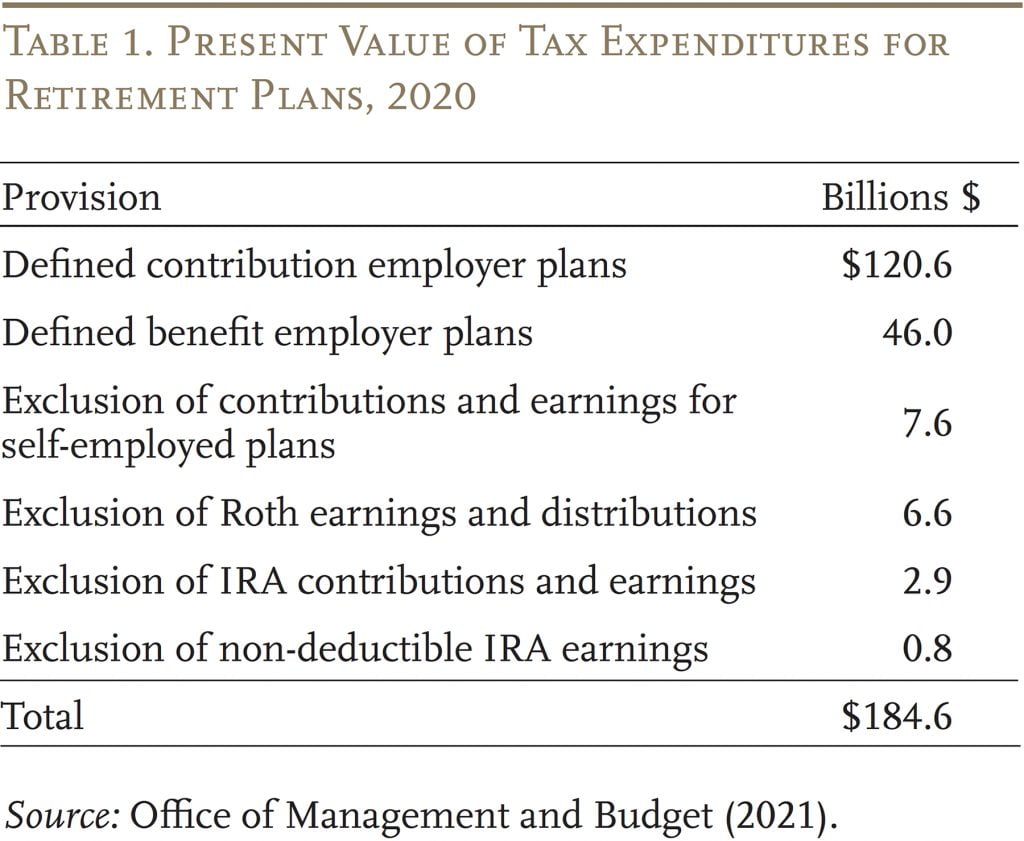

A better approach to measuring the cost of the favorable tax provisions is the difference in the net present value of the revenues from contributions in a given year under two tax rules – the rules for saving outside a retirement plan and the current favorable rules for saving in a retirement plan. The Treasury’s 2020 estimate for this present value concept was $185 billion (see Table 1).3In addition, most states effectively offer a similar tax incentive, as state incomes taxes are generally levied upon income as defined under federal law. As of 2020, state income taxes were equal to about 22 percent of federal income taxes, which implies an additional tax expenditure from states equal to about $41 billion. Figures for state and federal revenues are drawn from the U.S. Census Bureau (2020).

Revenue losses also extend to the payroll tax for Social Security and Medicare. In the case of DC retirement plans, employee contributions are taxed as earnings, but employer contributions are not. Thus, calculating the revenue loss involves applying only the employer portion of the payroll tax – 7.65 percent – to employer contributions. With respect to DB plans, the annual increase in the value of accrued DB benefits is excluded from the payroll tax base for both employers and employees, so the revenue loss estimate applies the full 15.3-percent payroll tax here. For 2020, our total estimate of the payroll tax revenue loss is $68 billion.4This estimate is very close to the CBO estimate for 2019. This revenue loss has never been considered a “tax expenditure” because of the subsequent budget implications – namely, broadening the payroll tax base would lead to higher Social Security benefits. The evidence, however, suggests that the budgetary impact of higher benefits would be substantially less than the increase in revenue.

In short, the tax preferences for retirement plans cost the Federal Treasury and Social Security/Medicare a significant amount of money. Who gets these preferences, and what do we receive in exchange?

Who Gets the Tax Expenditures?

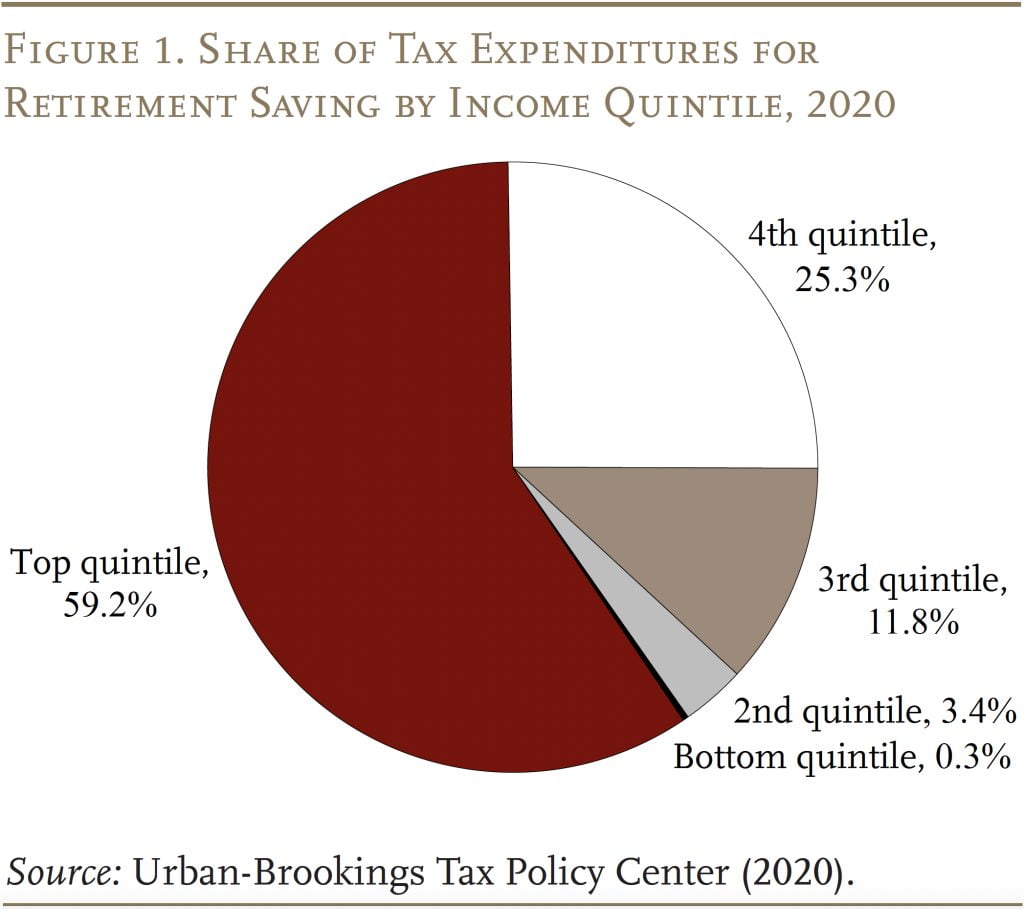

Tax expenditures for retirement saving are much more likely to benefit high earners than their low-earning counterparts, for a number of reasons.5For a detailed discussion of how tax preferences for retirement saving have been skewed towards high earners, see Doran (2022). Upper-income taxpayers are more likely to have access to employer-sponsored retirement plans, are more likely to participate in their employer’s plan, and contribute more when they do participate. Indeed, simulations from the Urban-Brookings Tax Policy Center suggest that 59 percent of the current tax expenditures for retirement saving flows to the top quintile of the income distribution (see Figure 1).6It is commonly argued that high-income households receive the lion’s share of the tax expenditure due to the progressive rate structure of the federal income tax. However, this argument ignores the impact of income taxes on savings withdrawn in retirement. Indeed, if tax rates decline more in retirement for low earners than for high earners, the tax preference per dollar of retirement plan contributions tends to be larger for low than high earners (see Brady 2016).

Over time, Congress has made two types of changes that result in the top quintile receiving an increasing proportion of tax expenditures. First, it introduced and then expanded so-called catch-up contributions for those ages 50 and over. Most recently, the SECURE 2.0 Act further increased the catch-up limits for those 60-63. Higher limits benefit only those constrained by the existing cutoffs: only 16 percent of participants in Vanguard plans took advantage of the catch-up feature and these were overwhelmingly high earners.7Vanguard (2023).

Another set of changes that principally benefits high-income households is the increase in the age for taking required minimum distributions from DC plans. Prior to January 2020, minimum distributions were required to begin at age 70½.8The Coronavirus Aid, Relief, and Economic Security (CARES) Act waived required minimum distributions during 2020 for IRAs and retirement plans, including for beneficiaries with inherited IRAs and accounts inherited in a retirement plan. The 2019 SECURE Act raised the age to 72, and the 2022 SECURE 2.0 Act further increased it to 73 in 2023 and 75 in 2033. Increasing the age requirement to 75 allows participants to take advantage of 4½ more years of tax-free growth. Generally, only the wealthiest will be able to benefit from this provision.9Earlier evidence on IRA holders – from when the required minimum distribution age was 70½ – indicated most people did not begin withdrawing until the required age (Doran 2022). However, these data reflect a past era when the required age was lower and retirees were much more likely to have DB plans. Looking ahead, most retirees with retirement savings will be reliant solely on DC plans, so they will need to withdraw this money well before 75; see, for example, Siliciano and Wettstein (2021).

What Do the Tax Expenditures Buy Us?

Given that the tax expenditures go overwhelmingly to upper-income households, who face almost no risk of poverty in old age, it is worth asking whether these expenditures accomplish some broader social goal such as increasing national saving or expanding the share of workers covered by a retirement plan.

Do the Tax Expenditures Increase Saving?

The tax subsidy for retirement saving may be justified if it promotes national capital formation. The increase in national capital formation is the sum of government saving – revenues less expenditures – and saving by individuals. Since the loss of revenues produced by the tax expenditure reduces government saving, the question is whether people covered by retirment plans increase their saving by enough to make up for this loss. The weight of the evidence indicates that they do not.

It might initially seem that tax preferences do indeed increase national saving. After all, the tax preferences make retirement saving more attractive to the savers and massive amounts have been accumulated in retirement plans. But the economists’ lifecycle model suggests that people may simply shift savings from ordinary taxable investment accounts to tax-favored retirement accounts in order to reap the benefits of the tax preference.10See Attanasio and DeLeire (2002) and Attanasio, Banks and Wakefield (2004). If we assume that 65 to 70 cents of each dollar of retirement plan savings otherwise would have been saved in taxable investment accounts,11This estimate is consistent with the results in the academic literature. For example, Munnell (1976) found an offset of $0.62 per dollar. In a more recent paper, Card and Ransom (2011) found an offset of $0.60 to $0.80 per dollar for employee contributions and half that for employer contributions. about $644 billion of the $954 billion in annual retirement plan contributions would have occurred regardless, leaving a net increment to savings of $310 billion. With the Treasury’s revenue loss estimate of $185 billion, it seems that the bulk of the increase in private saving may have been offset by the reduction in government saving.

Similarly, recent studies of automatic saving policies such as 401(k) defaults have found they are quite effective at increasing participation in retirement plans, but it remains unclear whether they raise total household saving. For instance, a 2022 study found that automatic enrollment of Department of Defense employees in the federal government’s Thrift Savings Plan significantly increased plan balances, but had little or no effect on participants’ net worth.12Beshears et al. (2022). In such cases, national saving would decrease due to the budgetary cost of the tax preference.

Likewise, if a household targeted a specific figure for their retirement saving, such as a dollar amount at retirement or the ability to replace some percentage of their pre-retirement earnings, a tax preference for retirement saving effectively increases the after-tax return, which could cause the household to save less.

In short, theory does not provide a strong basis to assume that the federal tax preferences must increase net total saving. Thus, the question must be resolved empirically. In the mid-1990s, two prominent studies came to conflicting conclusions regarding the efficacy of the retirement saving tax preference.13See, for example, Engen, Gale and Scholz (1996) and Poterba, Venti and Wise (1996), who come to diametrically opposite conclusions. Since that time, however, additional studies using new data and methods have largely concluded that the net effects of the tax preference are small.14For instance, one 2003 study estimated that only about one quarter of 401(k) balances represent net saving to the economy (Benjamin 2003). For each dollar of savings inside of 401(k)s, about 25 cents are offset by the cost of the federal tax incentive and about 50 cents are offset by lower household saving in other areas, such as taxable investment accounts. A separate 2002 study published by the Federal Reserve reached similar conclusions (Pence 2002). But research focusing on the United States has been impeded by the lack of high-quality data on saving and wealth.

As a result, economists turned to Danish tax data, which track the income, saving, and wealth of over 4 million people.15Chetty et al. (2014). To test the effect of tax subsidies, they used responses to a 1999 reduction in the subsidy for retirement contributions for those in the top tax bracket. The results show that, for some, pension contributions declined. But the decline was nearly entirely offset by an increase in other types of saving. The tax subsidy, in other words, had primarily induced individuals to shift their saving from taxable to tax-advantaged retirement accounts, not to increase overall household saving. The response was also highly concentrated, with most individuals doing nothing and only about 15 percent shifting their saving. The authors concluded that tax incentives had virtually no impact on retirement saving.

The results of this study have been well received and broadly accepted. The weight of the evidence indicates that tax incentives do not increase total saving in a meaningful way.

Do the Tax Expenditures Improve Coverage?

It is possible that, even if the tax incentive does not induce high-income households to increase their total retirement saving, the incentive does encourage firms to offer retirement plans. In the process, workplace retirement plans would be offered to lower-paid employees, who currently lack a convenient way to save for retirement.16For more details on policy goals and coverage shortfalls, see Halperin and Munnell (2005). However, little research has produced any evidence of a relationship between tax expenditures and retirement plan coverage.

For instance, if the retirement saving tax expenditure accruing to high-earners increased the availability of workplace retirement plans to low- and middle-earners, one might expect retirement plan coverage to be higher in states that levy high state income taxes on high earners, as the federal tax expenditure serves to reduce state income tax liabilities as well. However, after controlling for a variety of demographic and labor force characteristics, no statistically significant relationship exists between the maximum income tax rate levied by a state and the percentage of employees offered a retirement plan at work.17This finding is from a preliminary analysis; we intend to conduct a more in-depth investigation into this issue.

Moreover, the percentage of workers participating in a retirement plan has not increased over time (see Figure 2). On the other hand, neither have tax expenditures as a percentage of GDP. Thus, it is possible that coverage is higher than it would have been in the absence of the tax expenditures, but, again, no evidence supports such a contention.

Even if the retirement tax expenditure did increase retirement plan coverage, far less expensive means exist to achieve this goal, such as a government mandate to enroll employees in a retirement plan. For instance, in 2008 the United Kingdom established a system that requires all private sector employers to auto-enroll their workers in a retirement plan.18This mandate applies to all employees who are: 1) ages 22 or older, up to the “state pension age” (66 in 2023); and 2) earn at least £10,000 ($12,600) per year. The employer can choose between adopting its own plan or using the National Employment Savings Trust (NEST), a defined contribution plan run by a public corporation.19The UK does require that employers partially match employees’ contributions, but this aspect of the program is distinct from the provisions that achieved nearly universal retirement plan coverage. NEST does not impose any administrative costs on employers, as such costs are borne by employees through fees.

The United States, however, with a strictly voluntary private-sector retirement system, has no room for mandates. Without a mandate or a subsidy via tax expenditures, though, would employers still offer plans?20Some have suggested that, without tax incentives, employers would not offer retirement plans. See, for example, VanDerhei (2011). It is important to remember that retirement plans existed before the income tax, so tax benefits are clearly not the only reason employers sponsor retirement plans. Employers viewed DB pensions as a valuable tool for managing their workforce. These plans provided benefits based on final pay and years on the job. As a result, the value of pension benefits increased rapidly as job tenure lengthened, which motivated employees to stay with the firm. DB plans also encouraged employees to retire when their productivity began to decline.

While the contribution of DC plans to personnel management may appear less compelling – they have no penalty for changing jobs and no retirement incentives – economists contend that DC plans help employers attract and retain high-quality workers who have low discount rates and value saving.21Ippolito (1997). Employer-sponsored plans also tend to have cost and convenience advantages over do-it-yourself IRA plans, making such plans an attractive benefit for employees. Moreover, employers have a real interest in making sure their employees have the resources to retire once their productivity falls off.

While employers have economic incentives to offer plans, it may be time to ask whether employer-centered arrangements make the most sense. In fact, the ERISA Industry Committee, an organization representing the employee benefit plans of America’s largest employers, issued a report in 2007 suggesting “a new benefits platform for life security.” The new benefit offerings would be administered by competing third-party Benefits Administrators, with employers and individuals providing the funding. The structure would also enable individuals without an employer relationship to contribute to a retirement plan. Combining the new benefits platform with automatic enrollment might produce a much better retirement system.

In any case, the current approach of offering tax expenditures is expensive and does not appear to work.

Reducing Tax Expenditures for Retirement Plans

The following discussion focuses on traditional DC plans, which account for about two-thirds of the retirement-related revenue loss. Completely eliminating the tax expenditure for DC plans is straightforward – simply include both employee and employer contributions in the employee’s earnings and tax the returns on contributions like the returns on other saving.22Fairness would require that the new rules apply only to new contributions and not to the income on assets already in participants’ accounts. The Internal Revenue Service already has the information on employee and employer contributions, and could require companies to report earnings on equities and bonds and realized capital gains from these new contributions on an annual basis.23One problem is that participants would be assessed a tax on income earned within a plan that they cannot access before age 59½, so levying a tax at the plan level might be a more workable option. According to Treasury estimates, revenues would increase by $121 billion.

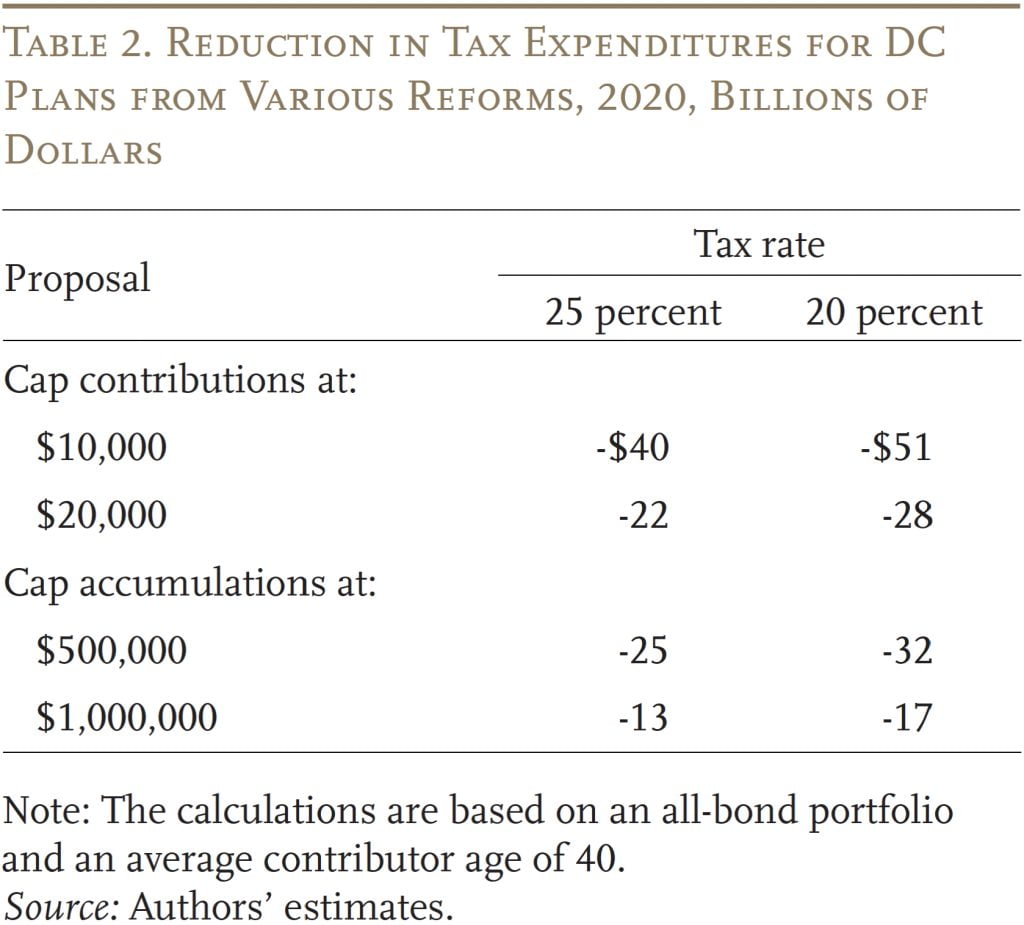

An alternative to eliminating the subsidy totally is to limit the amount of money that goes into a plan, and thereby the share of the subsidy going to high earners. One option is to restrict combined employee-employer contributions to, say, $10,000 or $20,000 per year. Another option would limit total accumulations in tax-favored retirement plans to, say, $500,000 or $1 million.24One approach would be a taxable mandatory required distribution following any year when the size of the account exceeds the limit (but with no extra penalty for withdrawals before age 59½).

To estimate the potential revenue gains from such an approach requires using a simple model to establish a benchmark and then estimating the impact of applying different caps. The model requires only a few pieces of information: the amount contributed to DC plans, the rate of return earned on investments, the rate used to discount future values to the present, the length of time the money is held in the plan, and the average marginal tax rate before and after retirement. The calculation then involves comparing Treasury receipts if the saving occurred outside a retirement plan to receipts when the money is accumulated inside a plan.25For an earlier analysis, see Munnell, Quinby, and Webb (2012).

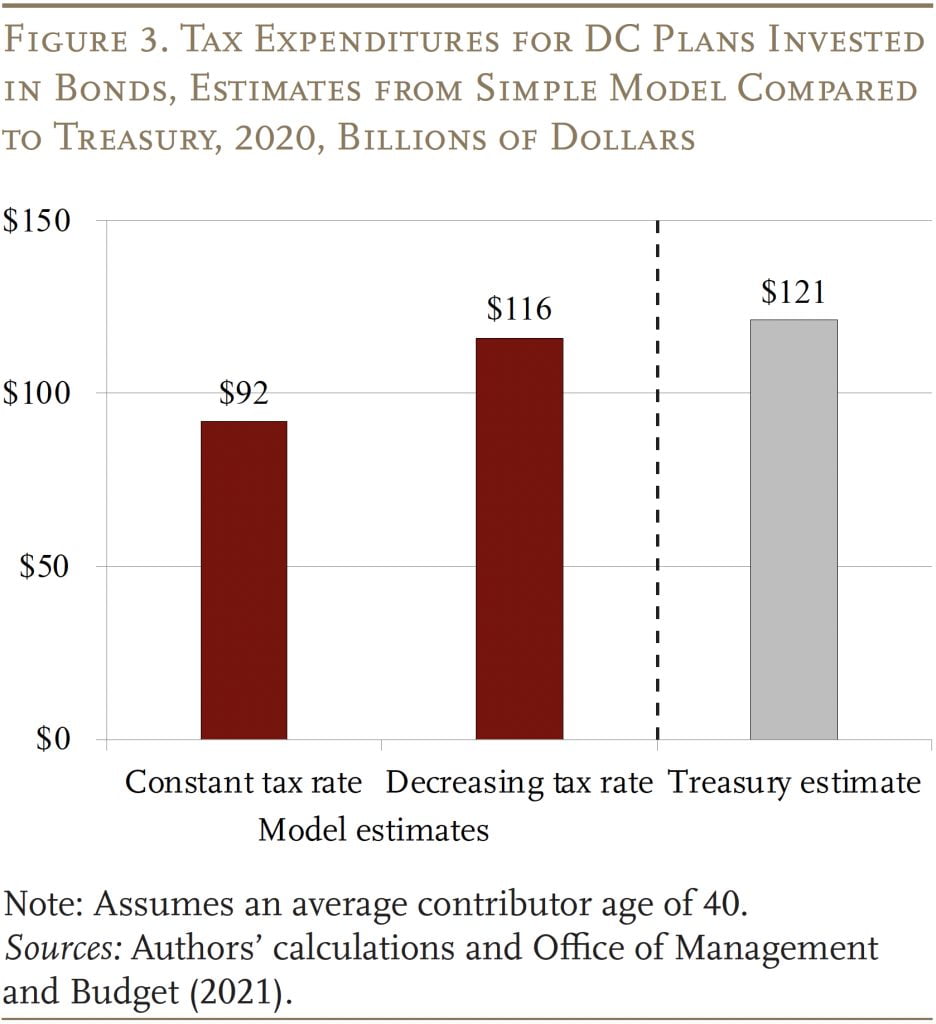

The model assumes – like the Treasury – that all money in DC plans is invested in bonds26In fact, all DC money is not invested in bonds; rather, 70 percent is in equities. and that bonds yield a real return of 2.5 percent. Further, the calculation assumes that the rate of return equals the discount rate.27Our assumed returns for both bonds and equities are historic averages from Damodaran (2022). Using the same value for the rate of return and the discount rate avoids the possibility of tax arbitrage in which either the federal government or the taxpayer can earn greater returns by investing themselves. See the response of Auerbach, Gale, and Orszag (2003) to Boskin (2003). Contributions to private-sector DC plans ($526 billion) and the Federal Thrift Savings Plan ($36 billion) in 2020 totaled $562 billion. If contributors are age 40, the entire account is liquidated and the remaining untaxed portion is taxed in full at age 80, and the average marginal tax rate is 25 percent, then the tax expenditure for 2020 would be $92 billion. However, substantial evidence suggests that people face lower tax rates in retirement than when working. Assume then that the tax rate drops to 20 percent between ages 70 and 80, so the revenue loss increases to $116 billion – very close to the Treasury estimate for 2020 (see Figure 3).

The next step is to estimate the impact of lowering the contribution limits. The 2019 Survey of Consumer Finances provides data on the share of contributions and accumulations above the proposed caps, and Table 2 shows the amount that the tax expenditure would be reduced under each option. The first column assumes that the tax rate remains at 25 percent and the second column assumes that the rate drops to 20 percent as contributions from high income decline in importance.

Numerous other options exist for cutting back on the current level of tax expenditures in DC plans, such as retaining the deduction (or replacing it with a credit) but then taxing the earnings on plan assets annually (the so-called inside buildup) and/or moving the age for taking the RMD back from the scheduled 75 to 70½. Whatever approach is taken, comparable changes would be required for Roth DCs and for DB plans to avoid a wholesale shift in plan type to retain the tax advantages.

Applying the Tax Savings to Social Security

The 2023 Social Security Trustees Report projects that, over the next 75 years, Social Security faces an actuarial deficit of 1.3 percent of gross domestic product.28U.S. Social Security Administration (2023). Over the same period, the Congressional Budget Office estimates a larger shortfall of 1.7 percent of GDP.29Congressional Budget Office (2023). Both groups project that Social Security’s combined trust funds will be exhausted in the early to mid-2030s, an event that without increased revenues will trigger reductions to retirement, disability and survivor benefits. As discussed, the U.S. Treasury’s 2020 estimated net present value of the retirement tax expenditure was about 0.9 percent of GDP, and the CBO’s estimate for 2019 was similar. In addition, including the effects of foregone payroll tax revenues would bring the total up to 1.3 percent of GDP, according to the CBO.30Congressional Budget Office (2021). Rollbacks of the ineffective retirement saving tax preference could fill a substantial portion of Social Security’s long-term funding gap.

In the shorter term, the revenue gains from reducing or eliminating the retirement tax preference would exceed the net present value figures estimated by Treasury and the CBO, because even if the tax preference were immediately eliminated today, the federal government would continue to collect income taxes on retirement plan benefits that were subject to the tax preference at the time the contributions were made.31Specifically, in 2020 public and private retirement plans paid out benefits and withdrawals equal to $1.5 trillion (U.S. Department of Commerce 2021). If these were taxed at a 20-percent rate, the federal government would collect revenues of $300 billion. Similarly, taxable distributions from IRAs paid to Americans 65 and over in 2020 were equal to $212 billion, which at a 20-percent assumed tax rate would yield an additional $42 billion in revenues (Internal Revenue Service 2023). Over time, as the new tax regime matured, increased revenues would decline to a steady state that more closely resembles the 2020 figure of $185 billion, adjusted for the expected growth of retirement contributions over time.

Reallocating the proceeds from eliminating or reducing the retirement tax expenditure to Social Security could help Democrats and Republicans bridge the decades-long divide over whether to maintain Social Security’s solvency by raising taxes or reducing benefits. Redirecting the tax expenditure to Social Security would reallocate existing funds that do not significantly improve retirement income security to a program that indisputably does. The front-loaded nature of savings from reducing the tax expenditure also could provide time for other changes to Social Security to be phased in. Finally, linking reductions to the tax expenditure to maintaining Social Security’s solvency could overcome the legislative inertia that has for years delayed action on Social Security reform.

Conclusion

Tax expenditures for employer-sponsored retirement plans are expensive – costing about $185 billion in 2020. And, strikingly, they appear to be a very bad deal for taxpayers. The current tax preferences primarily benefit high earners, and the tax expenditure has failed at its broader policy goals of increasing national saving or expanding plan coverage. Therefore, the case is strong for curtailing these tax breaks.

To reduce retirement tax expenditures, the government could limit contributions or accumulations in tax-favored plans or tax the earnings on these plans each year. While reducing these tax incentives could, perhaps, somewhat reduce interest among employers in offering work-based savings plans, alternative arrangements could be made to ensure that all workers have an organized way to save for retirement.

Ultimately, reducing tax expenditures for retirement plans could be an effective way to help address other pressing demands on the federal budget, such as Social Security’s financing shortfall.

References

Attanasio, Orazio P., James Banks, and Matthew Wakefield. 2004. “Effectiveness of Tax Incentives to Boost (Retirement) Saving: Theoretical Motivation and Empirical Evidence.” IFS Working Papers No. WP04/33. London, England: Institute for Fiscal Studies.

Attanasio, Orazio P. and Thomas DeLeire. 2002. “The Effect of Individual Retirement Accounts on Household Consumption and National Saving.” The Economic Journal 112(481): 504-538.

Auerbach, Alan, William G. Gale, and Peter R. Orszag. 2003. “Reassessing the Fiscal Gap: The Role of Tax-Deferred Saving.” Tax Notes 100(July 28): 567-584.

Benjamin, Daniel J. 2003. “Does 401(k) Eligibility Increase Saving?: Evidence from Propensity Score Subclassification.” Journal of Public Economics 87(5-6): 1259-1290.

Beshears, John, James J. Choi, David Laibson, Brigitte C. Madrian, and William L Skimmyhorn. 2022. “Borrowing to Save? The Impact of Automatic Enrollment on Debt.” The Journal of Finance 77(1): 403-447.

Biggs, Andrew G., Alicia H. Munnell, and Michael Wicklein. 2024. “The Case for Using Subsidies for Retirement Plans to Fix Social Security.” Working Paper 2024-1. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Boskin, Michael J. 2003. “Deferred Taxes in the Public Finances.” Working Paper. Stanford, CA: Hoover Institution.

Brady, Peter. 2016. “How America Supports Retirement: Challenging the Conventional Wisdom on Who Benefits.” Washington, DC: Investment Company Institute.

Card, David and Michael Ransom. 2011. “Pension Plan Characteristics and Framing Effects in Employee Savings Behavior.” The Review of Economics and Statistics 93(1): 228-243.

Chetty, Raj, John N. Friedman, Søren Leth-Petersen, Torben Heien Nielsen, Tore Olsen. 2014. “Active vs. Passive Decisions and Crowd-Out in Retirement Savings Accounts: Evidence from Denmark.” Quarterly Journal of Economics 129(3): 1141-1219.

CliftonLarsonAllen LLP. 2022. “Thrift Savings Fund: Financial Statements, 2021 and 2020.” Minneapolis, MN.

Congressional Budget Office. 2023. CBO’s 2023 Long-Term Projections for Social Security. Washington, DC.

Congressional Budget Office. 2019. The Distribution of Major Tax Expenditures in 2019. Washington, DC.

Damodaran, Aswath. 2022. Historical Returns on Stocks, Bonds, and Bills – United States. New York, NY: New York University, Stern School of Business.

Doran, Michael. 2022. “The Great American Retirement Fraud.” Elder Law Journal 30(1): 265-347.

Engen, Eric M., William G. Gale, and John Karl Scholz. 1996. “The Illusory Effects of Saving Incentives on Saving.” Journal of Economic Perspectives 10(4): 113-138.

Halperin, Daniel I. and Alicia H. Munnell. 2005. “Ensuring Retirement Income for All Workers.” In The Evolving Pension System: Trends, Effects, and Proposals for Reform, edited by William G. Gale, John B. Shoven, and Mark J. Warshawsky, 155-190. Washington, DC: Brooking Institution Press.

Internal Revenue Service. 2023. “IRA Contribution Information for Tax Year 2020.” Washington, DC: U.S. Department of the Treasury.

Ippolito, Richard A. 1997. Pension Plans and Employee Performance. Chicago, IL: University of Chicago Press.

Munnell, Alicia H. 1976. “Private Pensions and Saving: New Evidence.” Journal of Political Economy 84(5): 1013-1032.

Munnell, Alicia H., Laura Quinby, and Anthony Webb. 2012. “What’s the Tax Advantage of 401(k)s?” Issue in Brief 12-4. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Office of Management and Budget. 2021. Analytical Perspectives, Budget of the U.S. Government, Fiscal Year 2022. Washington, DC.

Pence, Karen M. 2002. 401(k)s and Household Saving: New Evidence from the Survey of Consumer Finances. Washington, DC: U.S. Board of Governors of the Federal Reserve System.

Poterba, James M., Steven F. Venti, and David A. Wise. 1996. “How Retirement Saving Programs Increase Saving.” Journal of Economic Perspectives 10(4): 91-112.

Siliciano, Robert and Gal Wettstein. 2021. “Can the Drawdown Patterns of Earlier Cohorts Help Predict Boomers’ Behavior?” Working Paper 2021-11. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Urban-Brookings Tax Policy Center. 2020. “Urban-Brookings Tax Policy Microsimulation Model.” Washington, DC.

U.S. Board of Governors of the Federal Reserve System. Survey of Consumer Finances, 1989-2022. Washington, DC.

U.S. Census Bureau. 2020. “2020 State & Local Government Finance Historical Datasets and Tables.” Washington, DC.

U.S. Department of Commerce, Bureau of Economic Analysis. 2021. National Income and Product Accounts, 2020. Washington, DC.

U.S. Social Security Administration. 2023. The Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds. Washington, DC: U.S. Government Printing Office.

VanDerhei, Jack. 2011. “Tax Reform Options: Promoting Retirement Security.” Issue Brief No. 364. Washington, DC: Employee Benefit Research Institute.

Endnotes

- 1Analysts use two different approaches for measuring tax expenditures under the federal income tax system: present value and cash flow. The Treasury has estimates for both measures: $185 billion for present value and $189 billion for cash flow in 2020. The Congressional Budget Office has a present value estimate of $202 billion (0.9 percent of GDP) for 2019, and the Joint Committee on Taxation has a cash flow estimate of $292 billion (1.4 percent of GDP) for 2020. As discussed below, revenue losses from tax expenditure policies also extend to federal payroll taxes; the CBO estimated that this amount was $74 billion in 2019.

- 2Biggs, Munnell, and Wicklein (2024).

- 3In addition, most states effectively offer a similar tax incentive, as state incomes taxes are generally levied upon income as defined under federal law. As of 2020, state income taxes were equal to about 22 percent of federal income taxes, which implies an additional tax expenditure from states equal to about $41 billion. Figures for state and federal revenues are drawn from the U.S. Census Bureau (2020).

- 4This estimate is very close to the CBO estimate for 2019. This revenue loss has never been considered a “tax expenditure” because of the subsequent budget implications – namely, broadening the payroll tax base would lead to higher Social Security benefits. The evidence, however, suggests that the budgetary impact of higher benefits would be substantially less than the increase in revenue.

- 5For a detailed discussion of how tax preferences for retirement saving have been skewed towards high earners, see Doran (2022).

- 6It is commonly argued that high-income households receive the lion’s share of the tax expenditure due to the progressive rate structure of the federal income tax. However, this argument ignores the impact of income taxes on savings withdrawn in retirement. Indeed, if tax rates decline more in retirement for low earners than for high earners, the tax preference per dollar of retirement plan contributions tends to be larger for low than high earners (see Brady 2016).

- 7Vanguard (2023).

- 8The Coronavirus Aid, Relief, and Economic Security (CARES) Act waived required minimum distributions during 2020 for IRAs and retirement plans, including for beneficiaries with inherited IRAs and accounts inherited in a retirement plan.

- 9Earlier evidence on IRA holders – from when the required minimum distribution age was 70½ – indicated most people did not begin withdrawing until the required age (Doran 2022). However, these data reflect a past era when the required age was lower and retirees were much more likely to have DB plans. Looking ahead, most retirees with retirement savings will be reliant solely on DC plans, so they will need to withdraw this money well before 75; see, for example, Siliciano and Wettstein (2021).

- 10See Attanasio and DeLeire (2002) and Attanasio, Banks and Wakefield (2004).

- 11This estimate is consistent with the results in the academic literature. For example, Munnell (1976) found an offset of $0.62 per dollar. In a more recent paper, Card and Ransom (2011) found an offset of $0.60 to $0.80 per dollar for employee contributions and half that for employer contributions.

- 12Beshears et al. (2022).

- 13See, for example, Engen, Gale and Scholz (1996) and Poterba, Venti and Wise (1996), who come to diametrically opposite conclusions.

- 14For instance, one 2003 study estimated that only about one quarter of 401(k) balances represent net saving to the economy (Benjamin 2003). For each dollar of savings inside of 401(k)s, about 25 cents are offset by the cost of the federal tax incentive and about 50 cents are offset by lower household saving in other areas, such as taxable investment accounts. A separate 2002 study published by the Federal Reserve reached similar conclusions (Pence 2002).

- 15Chetty et al. (2014).

- 16For more details on policy goals and coverage shortfalls, see Halperin and Munnell (2005).

- 17This finding is from a preliminary analysis; we intend to conduct a more in-depth investigation into this issue.

- 18This mandate applies to all employees who are: 1) ages 22 or older, up to the “state pension age” (66 in 2023); and 2) earn at least £10,000 ($12,600) per year.

- 19The UK does require that employers partially match employees’ contributions, but this aspect of the program is distinct from the provisions that achieved nearly universal retirement plan coverage. NEST does not impose any administrative costs on employers, as such costs are borne by employees through fees.

- 20Some have suggested that, without tax incentives, employers would not offer retirement plans. See, for example, VanDerhei (2011).

- 21Ippolito (1997).

- 22Fairness would require that the new rules apply only to new contributions and not to the income on assets already in participants’ accounts.

- 23One problem is that participants would be assessed a tax on income earned within a plan that they cannot access before age 59½, so levying a tax at the plan level might be a more workable option.

- 24One approach would be a taxable mandatory required distribution following any year when the size of the account exceeds the limit (but with no extra penalty for withdrawals before age 59½).

- 25For an earlier analysis, see Munnell, Quinby, and Webb (2012).

- 26In fact, all DC money is not invested in bonds; rather, 70 percent is in equities.

- 27Our assumed returns for both bonds and equities are historic averages from Damodaran (2022). Using the same value for the rate of return and the discount rate avoids the possibility of tax arbitrage in which either the federal government or the taxpayer can earn greater returns by investing themselves. See the response of Auerbach, Gale, and Orszag (2003) to Boskin (2003).

- 28U.S. Social Security Administration (2023).

- 29Congressional Budget Office (2023).

- 30Congressional Budget Office (2021).

- 31Specifically, in 2020 public and private retirement plans paid out benefits and withdrawals equal to $1.5 trillion (U.S. Department of Commerce 2021). If these were taxed at a 20-percent rate, the federal government would collect revenues of $300 billion. Similarly, taxable distributions from IRAs paid to Americans 65 and over in 2020 were equal to $212 billion, which at a 20-percent assumed tax rate would yield an additional $42 billion in revenues (Internal Revenue Service 2023). Over time, as the new tax regime matured, increased revenues would decline to a steady state that more closely resembles the 2020 figure of $185 billion, adjusted for the expected growth of retirement contributions over time.