White-Black 401k Gap Widens for the Old and the Rich

The stark difference in Black and White workers’ wealth is old news. But now we have some fresh information about the wealth gap: it grows as people age and move through their retirement years.

The most striking deterioration in Blacks’ relative standing can be seen in non-housing wealth. This mainly consists of 401(k)-style plans and savings and investment accounts and does not include the wealth inherent in retirees’ Social Security or employer pensions.

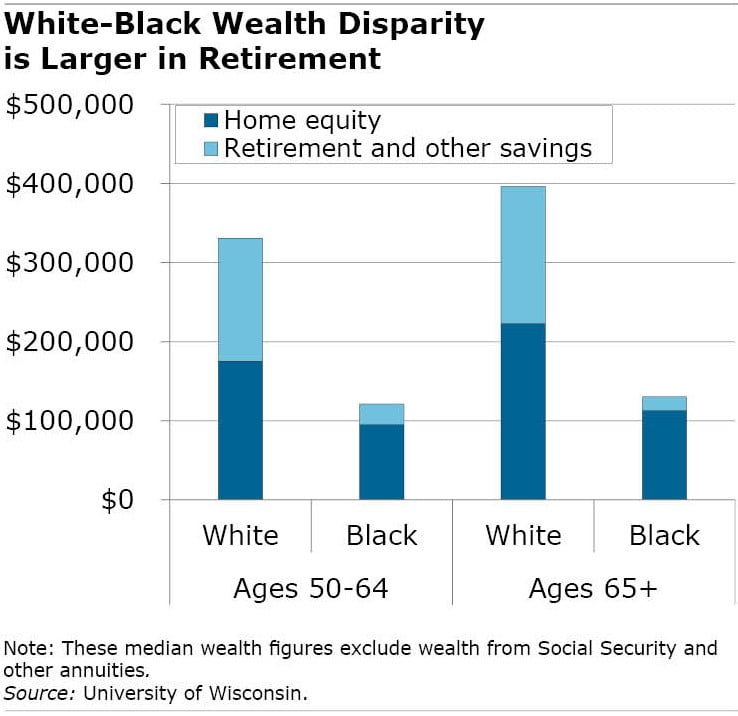

In the final years before retirement, the typical White household between ages 50 and 64 has accumulated six times more non-housing wealth than a Black household at that age, according to a new study.

During retirement, that imbalance balloons to a tenfold difference – about $173,000 for Whites over 65 vs. $18,000 for Black retirees.

Owning a house is another form of wealth. The White homeownership rate is consistently above 80 percent until retirees reach their advanced years. The Black homeownership rate ranges from 60 to 70 percent for older workers and retirees, and since Black workers tend to buy less expensive houses, they build up less home equity over the years.

Although they are at a disadvantage here too, the disparity in housing wealth is somewhat smaller than that for non-housing wealth. But it persists. When home equity is added to retirement and other savings, the total household wealth of the typical older White worker or retiree is roughly three times more than their Black counterparts.

Digging further into the data, the researchers show how this dynamic plays out for each five-year increase in their ages. Not only do White workers over 50 have more wealth to start with but they also build it up faster – if older Black workers accumulate wealth at all. As this financial inequity carries over into retirement, it accelerates, particularly for the non-housing portion of their wealth. Black retirees’ debt levels are also much higher.

Another group that loses ground over time are the wealthiest Black households. The richer they are, the study found, “the more slowly their wealth grows relative to White households with similar initial wealth.”

The researchers also looked at inequality when the benefits from two of Social Security’s programs – Supplemental Security Income, or SSI, and federal disability – are included in their analysis. Both shrink the racial inequities in wealth. SSI, which supports the disabled and low-income Americans over 65, has the largest effect.

Disability benefits, with their progressive formula for low-income retirees, are somewhat more helpful to older Black workers than Whites until they start receiving their Social Security retirement benefits. Other research has shown that once people start their retirement benefits, which also have a progressive formula, the wealth gap shrinks.

This study is a good start on understanding how the wealth gap evolves over a lifetime. Inheritances are another aspect of this: two out of 10 White households in their early 60s receive inheritances – double the rate for Blacks.

More research on the channels behind the racial gap in wealth accumulation is needed to find policies that would reduce it, the researchers said.

To read this study by Samuel Myers, Illenin Kondo, Teegawende Zeida, and William Darity Jr., see “Social Security Policy Design and Racial Wealth Disparities.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

This is why quality ‘Financial Literacy’ needs to be stressed, encouraged, and taught by ALL organizations: churches, government, schools and private business starting early in everyone’s life. Financial Literacy begins in the adolescent years, throughout the teens and then into adulthood. It should be taught that taking care of one’s financial affairs never ends. Needs over wants have to be stressed over and over again.