Who Works After Claiming Social Security?

The brief’s key findings are:

- Since Social Security aims to replace wages for those no longer working, claiming benefits is often seen as a simple proxy for retirement.

- Many older households, though, report both labor earnings and Social Security, indicating that some household members claim before fully retiring.

- Our results show that about 40 percent of individuals work at some point after claiming, typically for several years and for non-trivial earnings.

- Most of them are lower lifetime earners who claim around 62 and then work part time, so they may struggle to delay Social Security claiming.

- The rest are higher earners who often work full time after claiming near the full retirement age, suggesting they may be able to further delay claiming.

Introduction

Social Security was designed to replace wages for those no longer working, so claiming Social Security benefits is often used as a simple proxy for retirement. However, trends in employment at older ages cast some doubt on this assumption: many households over 65 report labor earnings as well as Social Security income, indicating that a non-trivial share of workers claim benefits before fully stopping work.1 Understanding this behavior is important for evaluating households’ retirement preparedness, as well as the design of Social Security, particularly regarding potential increases in the program’s Full Retirement Age (FRA).2

This brief examines the older workers who claim Social Security and work at the same time, addressing two questions: 1) how many are doing it? and 2) what are their characteristics? The discussion proceeds as follows. The first section provides background on Social Security claiming and retirement. The second section documents the share of individuals who ever work after claiming their benefits. The third section describes the demographic and employment characteristics of these worker-beneficiaries. The final section concludes that around 40 percent of individuals do some work after claiming, a pattern that has persisted over time. Twenty-nine percent of individuals seem to use Social Security income to supplement reduced earnings and have limited capacity to delay claiming. Another 13 percent have greater financial flexibility and could more easily delay to increase their monthly Social Security benefits.

Background

Many studies of older households use receipt of Social Security benefits as a simple and straightforward way to classify individuals as retired. That is, they assume most individuals claim around the time they exit employment.3 This assumption reflects the consequential nature of the claiming decision – claiming before the FRA permanently reduces monthly benefits, while delaying until age 70 maximizes them through delayed retirement credits. In many cases, claiming later also increases expected lifetime benefits.4 Additionally, the program’s design can discourage claiming while working because beneficiaries under the FRA are subject to an earnings test that temporarily withholds a portion of benefits.5

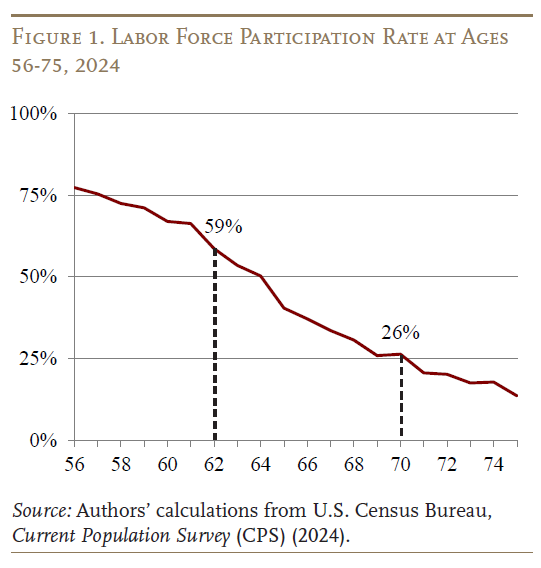

However, growing evidence indicates that Social Security claiming does not necessarily signal full retirement. A quick look at the Current Population Survey shows that many older workers remain in the labor force even after becoming eligible for Social Security (see Figure 1). Indeed, although the labor force participation rate declines sharply after people reach age 62, it remains above a quarter through age 70.6 These relatively high labor force participation rates are consistent with recent studies showing that earnings constitute more than a fifth of income for households over age 65.7

The persistence of employment after typical claiming ages suggests that some workers claim Social Security and work at the same time. Understanding this behavior matters for evaluating households’ retirement preparedness and the design of the Social Security program. If individuals who work after claiming are disadvantaged and rely on Social Security benefits to supplement reduced earnings, benefit cuts such as raising the FRA may hurt them disproportionately.8 Conversely, if they have the financial capacity to delay claiming, policymakers could encourage them to do so. To assess the policy implications of work after claiming, the next section first establishes the prevalence of this behavior.

How Many People Work After Claiming?

To examine Social Security beneficiaries who are still working, our analysis uses the 1992-2022 Health and Retirement Study (HRS), a biennial longitudinal survey with detailed information on Social Security claiming, employment, and income. Most prior work on this issue focuses on a point-in-time snapshot capturing the share of older individuals who have both earnings and Social Security income in any given year.9 We also start with this approach, identifying those who reported working at the time of their HRS interview, earned a minimum amount in the past calendar year, and who also indicated that they claimed Social Security retirement benefits prior to the interview.10

In 2018 (before the pandemic disrupted both work and claiming), 13 percent of individuals ages 62-75 met these criteria for worker-beneficiaries.11 Interestingly, working after claiming is not a new phenomenon – the share was actually a bit higher two decades before. The earnings of these worker-beneficiaries are also not trivial, constituting about 40 percent of their household income on average.

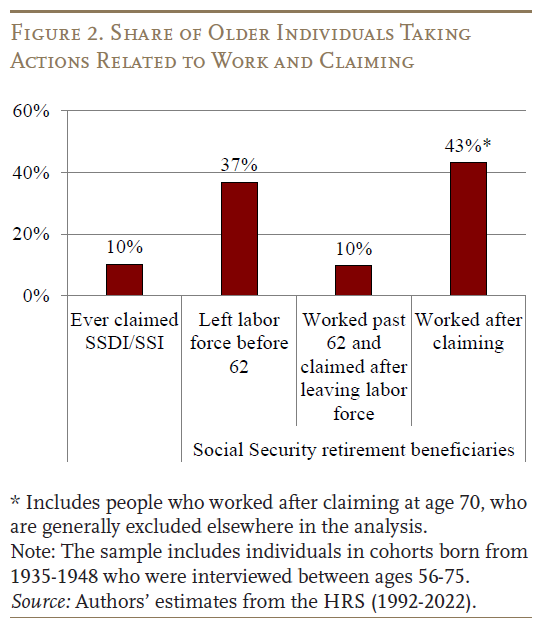

However, point-in-time estimates understate the true prevalence of working after claiming since they include some workers who are not yet beneficiaries but may be eventually, as well as some beneficiaries who are not currently working but did work earlier. Hence, to understand the extent of work after claiming, we next examine lifetime patterns. Specifically, the analysis uses the HRS to track individuals from age 56 – when the vast majority are still in the labor force – to age 75, when most have fully retired.12 The HRS interviews respondents once every two years, with the first post-claiming interview in our sample typically occuring about one year after respondents have claimed their benefits. Hence, we observe any employment reported in that initial post-claiming interview as well as at two-year intervals thereafter. This longitudinal view shows that working after claiming Social Security retirement benefits is indeed more common over the lifetime – around 40 percent of older individuals report ever working after their claiming date, either because they start claiming before they retire, or because they go back to work after an initial retirement (see Figure 2).13

The bottom line is that around 40 percent of older individuals claim their Social Security benefits before fully retiring and this phenomenon is not new.

Who Works After Claiming Retirement Benefits?

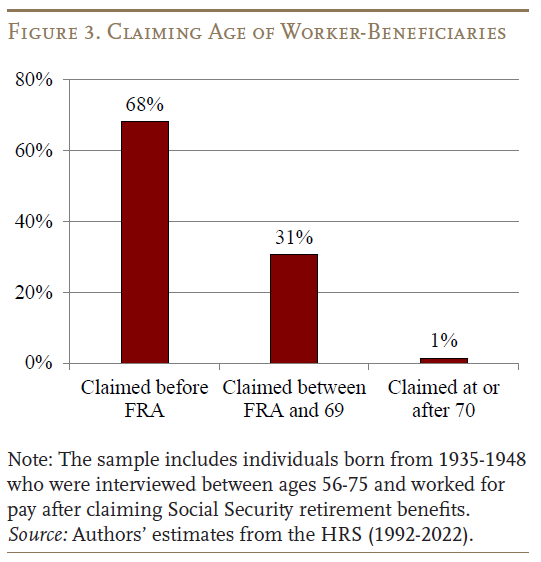

Despite the prevalence of working after claiming, little is known about the characteristics or motivations of the workers who do so. To take an initial look at this topic, we first examine when these workers choose to claim. As shown in Figure 3, two-thirds of them claim before the FRA – typically right at age 62 – while another 30 percent claim between the FRA and age 69 – typically right at the FRA.14 Since very few claim at age 70 (when monthly benefits reach their maximum) or later, the following analysis focuses on those who claim before then.

Among worker-beneficiaries, the timing of claiming probably reflects different characteristics and circumstances. Since the earnings test could discourage significant work activity for early claimants, those who claim before the FRA likely do so because they cannot, or choose not to, continue working at full capacity. In this case, Social Security benefits may provide the income needed to phase into retirement – a common reason cited for early claiming.15 The motivations of those who claim between the FRA and age 69 and then keep working are more complex. These workers are no longer subject to the earnings test, yet they decide not to delay claiming to 70. Their decisions could reflect social norms around the FRA, a desire to move into transitional bridge employment at that time, or the claiming of Social Security spousal benefits (which unlike worker benefits do not increase after the FRA).16

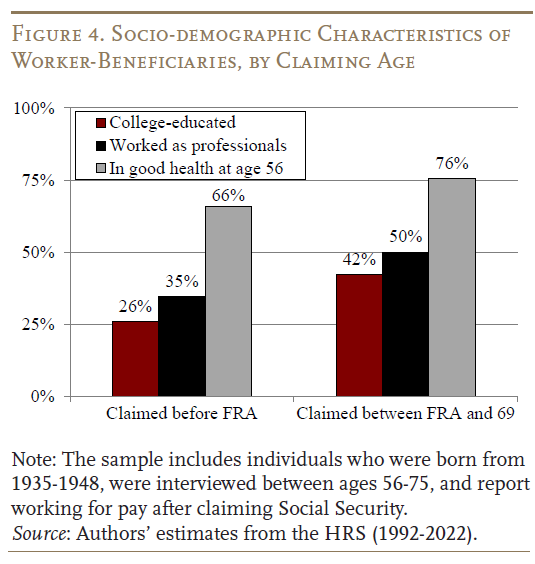

To evaluate the hypothesis of two groups of worker-beneficiaries, the analysis next examines their pre-claiming characteristics.17 As expected, early claimants are less likely to hold college degrees and less likely to have careers in managerial or professional occupations – characteristics that make them less able to work longer in comfortable conditions as well as more financially vulnerable in retirement (see Figure 4). Both groups are relatively healthy as they approach retirement, although early claimants report good health at somewhat lower rates.

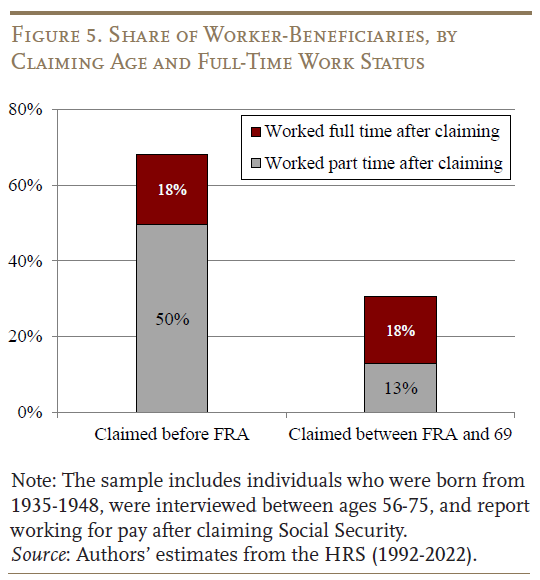

Examining employment patterns further supports this story. Worker-beneficiaries who claim before the FRA are mostly working part time – half of all worker-beneficiaries claim before the FRA and work part time, while only 18 percent claim early and work full time (see Figure 5). In contrast, a majority of their counterparts who claim between the FRA and age 69 are working full time. For the early claimants, this pattern is consistent with using Social Security benefits to supplement reduced earnings while gradually transitioning out of the labor force.18

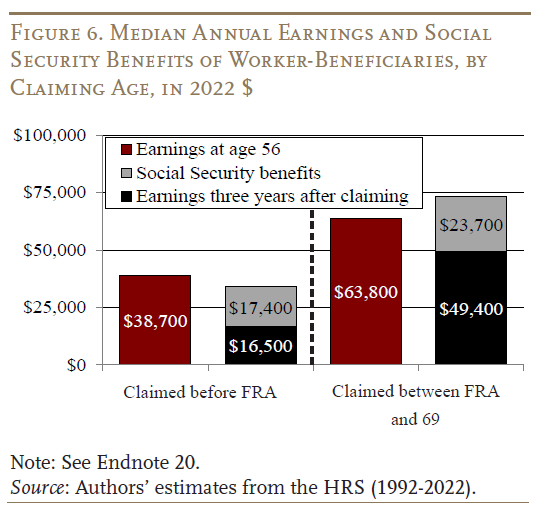

Additional support comes from looking at earnings and Social Security benefits, in particular how well worker-beneficiaries replace their pre-claiming earnings. Specifically, we compare earnings at age 56 – before most retirement transitions begin – with those observed in the survey wave following initial receipt of Social Security benefits, which typically takes place three years after claiming.19 Worker-beneficiaries who claim early typically have lower pre-claiming earnings and cannot fully replace what they were earning at age 56. Indeed, median earnings decrease by almost half from $38,700 to $16,500, and Social Security does not fully offset the gap (see Figure 6).20

In contrast, median earnings of those who claim between the FRA and age 69 show a much smaller decline. Moreover, the combination of post-claiming earnings and Social Security benefits exceeds what they were earning before, suggesting that some in this group may have the financial capacity to delay claiming further.

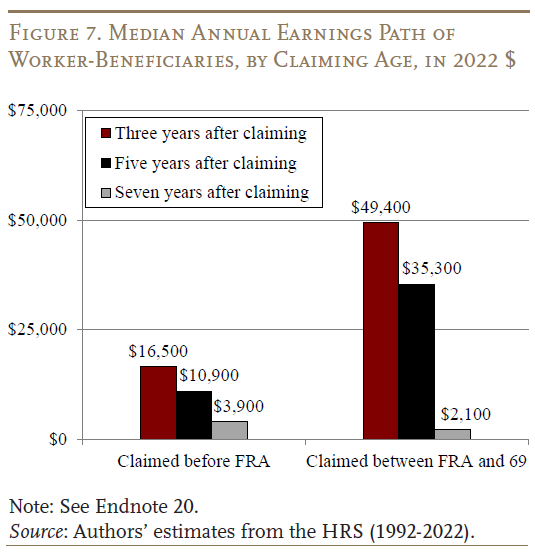

A final question is how long beneficiaries spend working – is it a short-term activity that allows new claimants to ease into retirement, or a longer-term arrangement? Tracking the median earnings of worker-beneficiaries over time shows that, regardless of claiming age, substantial work activities continue until five years after claiming, though at gradually declining levels (see Figure 7). By seven years after claiming, median earnings have fallen to minimal levels, suggesting a transitional behavior, albeit a slow one. That said, since worker-beneficiaries who claim after the FRA typically do so right at age 66, sustained work activity for an additional five years indicates that some could potentially delay claiming until 70.

The overall conclusion is that working after claiming serves different purposes for different groups. Two-thirds of these worker-beneficiaries rely on Social Security to supplement reduced earnings and may have limited capacity to delay claiming, while the remaining third maintain substantial earnings levels for several years, on average, suggesting greater financial flexibility to delay.

Conclusion

Receipt of Social Security benefits is often used as a shorthand to classify an individual as retired. Contrary to this conventional wisdom, working after claiming has long been a path chosen by a significant share of workers, with around 40 percent of individuals ages 62-75 doing so at some point over the past two decades. This brief finds that these worker-beneficiaries fall into two groups.

The first group – 29 percent of all individuals – claim as early as they can and use Social Security to supplement significantly reduced earnings. Policies like raising the FRA may disproportionately harm these workers, who are less likely to hold the types of white-collar jobs that facilitate working longer. In contrast, the remaining 13 percent typically work full-time and see increased total income as a result. While their motivations for claiming remain unclear, they seem to have significant work capacity and could perhaps be nudged to delay claiming to potentially increase their lifetime benefits. Future research should explore what drives their claiming decisions and whether targeted interventions could help them delay. Additionally, since work after claiming typically lasts about five years, future research should examine how this behavior impacts households’ overall retirement security.

References

Biggs, Andrew. 2023. “Will Retirees’ Incomes Be Enough? It Depends on What You Count as Income.” (June 19). New York, NY: Forbes.

Biggs, Andrew G., Anqi Chen, and Alicia H. Munnell. 2021. “The Consequences of Current Benefit Adjustments for Early and Delayed Claiming.” Working Paper 2021-3. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Bronshtein, Gila, Jason Scott, John B. Shoven, and Sita Nataraj Slavov. 2019. “The Power of Working Longer.” Journal of Pension Economics & Finance 18, No. 4: 623-644.

Cahill, Kevin E., Michael D. Giandrea, and Joseph F. Quinn. 2020. “Unretirement in the 2010s: Prevalence, Determinants, and Outcomes.” No. 529. Washington DC: U.S. Bureau of Labor Statistics.

Card, David, Nicole Maestas, and Patrick J. Purcell. 2014. “Labor Market Shocks and Early Social Security Benefit Claiming.” MRRC Working Paper 2014-317. University of Michigan Retirement Research Center.

Davis, Owen F., Laura D. Quinby, Matthew S. Rutledge, and Gal Wettstein. 2023. “How Did Covid-19 Affect the Labor Force Participation of Older Workers in the First Year of the Pandemic.” Journal of Pension Economics and Finance 22(4): 509-523.

Dushi, Irena, Brad Trenkamp, Charles Adam Bee, and Joshua W. Mitchell. 2025. “Measuring Income of the Aged in Household Surveys: Evidence from Linked Administrative Records.” Journal of Pension Economics and Finance 24(1): 95-122.

Ghilarducci, Teresa. 2024. “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy.” Chicago, IL: University of Chicago Press.

Harrington, Kelly, Luc Schuster, and Laura D. Quinby. 2025. “Wealth Gaps in the Golden Years: Economic Insecurity for Older Adults in a High-Cost State.” Boston, Massachusetts: Boston Indicators.

Maestas, Nicole. 2010. “Back to Work: Expectations and Realizations of Work After Retirement.” Journal of Human Resources 45 (3): 718-748.

Primus, Wendell, Tara Watson, and Jack A. Smalligan. 2025. “Fixing Social Security: Blueprint for a Bipartisan Solution.” Washington, DC: Center on Health Policy at Brookings.

Shoven, John B., Sita Nataraj Slavov, and David A. Wise. 2017. Social Security claiming decisions: survey evidence. No. w23729. National Bureau of Economic Research.

Sullivan, Sherry E., and Akram Al Ariss. 2019. “Employment after Retirement: A Review and Framework for Future Research.” Journal of Management 45(1): 262-284.

U.S. Census Bureau. 2024. Current Population Survey. Washington, DC.

U.S. Social Security Administration. 2025. Annual Statistical Supplement, 2025. Baltimore, MD.

University of Michigan. 1992-2022. Health and Retirement Study. Ann Arbor, MI.

Yin, Yimeng, Anqi Chen, and Alicia H. Munnell. 2023. “The National Retirement Risk Index with Varying Claiming Ages.” Issue in Brief 23-23. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Endnotes

- Dushi et al. (2025). ↩︎

- For example, at least one recent proposal has called for an earnings-based FRA that allows lower earners to retire earlier with full benefits while requiring higher earners to wait longer for full benefits (Primus, Watson, and Smalligan 2025). ↩︎

- For example, see Bronshtein et al. (2019). ↩︎

- Theoretically, actuarial adjustments are designed to equalize lifetime benefits regardless of claiming age for a person with average life expectancy. In practice, the reductions for claiming before the FRA are too large, and the delayed retirement credits are actuarially advantageous for most workers (Biggs, Chen, and Munnell 2021). Monthly benefits are determined at initial claiming, with the exception of earnings test adjustments that allow recoupment of withheld benefits. ↩︎

- Social Security withholds $1 in benefits for every $2 of earnings exceeding the lower exempt amount ($23,400 in 2025) and $1 for every $3 exceeding the higher exempt amount ($62,160 in 2025). Beneficiaries with withheld benefits receive actuarial adjustments that increase their monthly benefits upon reaching the FRA, when the earnings test no longer applies. ↩︎

- The analysis stops after age 75 because virtually all those eligible have claimed by then and labor force participation plummets as workers near their 80s. ↩︎

- Biggs (2023), Yin, Chen, and Munnell (2023), and Dushi et al. (2025). ↩︎

- See, for example, Harrington, Schuster, and Quinby (2025). ↩︎

- Yin, Chen, and Munnell (2023) examine earnings among Social Security beneficiaries. Ghilarducci (2024) shows that, in 2018, the majority of 65-year-old workers have claimed. A large literature shows the importance of earnings as a source of income for those ages 65+. For example, see Dushi et al. (2025). ↩︎

- Specifically, the analysis uses the respondents’ self-reported month and year of Social Security claiming and excludes employment of individuals who have ever claimed federal disability benefits. The main analysis sets the minimum required earnings threshold at $500 annually. We also tested the sensitivity of our analysis to this requirement and found that raising the minimum earnings threshold to $5,000 does not meaningfully change the results. Due to data limitations, we are unable to differentiate beneficiaries claiming retired worker benefits from those claiming spousal and survivor benefits. Since U.S. Social Security Administration (2025) shows that 92 percent of beneficiaries ages 62-75 claim retired worker benefits, we use the term Social Security retirement benefits broadly for simplicity. ↩︎

- See Davis et al. (2023) for a discussion of pandemic-related disruptions to the labor market for older workers. ↩︎

- We restrict the sample to those who were interviewed between ages 51-56 to obtain information on their pre-claiming employment; and we restrict it to those who were interviewed at least once after 75. ↩︎

- For a robustness check, we use a more restrictive definition requiring that work be observed in the survey wave after individuals first report receiving Social Security benefits for a full calendar year (which, on average, captures individuals three years post-claiming). This approach yields a similar rate of 38 percent. ↩︎

- The FRA is determined by birth year: for respondents in our sample, the FRA was 65 for those born before 1938, gradually increased to 66 for those born 1938-1942, and remained at 66 for those born 1943-1948. The median claiming age for worker-beneficiaries who claim before the FRA is age 62, compared to age 66 for those who claim between the FRA and 69. ↩︎

- Shoven, Slavov and Wise (2017) also discuss concerns about future benefit cuts due to policy changes and poor health as potential drivers. ↩︎

- Maestas (2010), Shoven, Slavov and Wise (2017), Sullivan and Al Ariss (2019), and Cahill, Giandrea, and Quinn (2020). ↩︎

- We also compared those who worked after claiming to two other groups shown in Figure 2 – individuals who did not work past age 62 and those who worked past age 62 but claimed after stopping work. Compared to those who worked past age 62, those who did not are more likely to be female, less likely to be college-educated, and more likely to report poor health. They also have more accrued wealth in defined benefit pensions, which may explain their early retirement. Among those who worked past age 62, individuals who worked after claiming, as a group, have similar characteristics to those who claimed after stopping work. But the overall averages may mask subgroup differences, as we show below. ↩︎

- Card, Maestas, and Purcell (2014) and Ghilarducci (2024). Ghilarducci (2024) also finds that work after claiming is prevalent in low-wage occupations such as personal care aides and cashiers. ↩︎

- We examine earnings reported in the survey wave after individuals first report receiving Social Security benefits for a full calendar year to ensure that we are not simply capturing partial-year earnings for workers who claim and stop work immediately, or who claim benefits a few months prior to permanent retirement. ↩︎

- The sample includes people born from 1935-1948, who were interviewed at least once after reaching age 75, started claiming before 70, and who worked after claiming. Post-claiming earnings and Social Security benefits are from the interview wave following a full calendar year after initial claiming. ↩︎