How Do Unpaid Student Loans Impact Social Security Benefits?

The brief’s key findings are:

- Student debt among retirees is not currently large, but their debt-holding and delinquency rates have been rising rapidly.

- Retirees with delinquent loans can have part of their Social Security benefits withheld to pay the loans.

- Black households are more likely to hold student debt and to have delinquent loans.

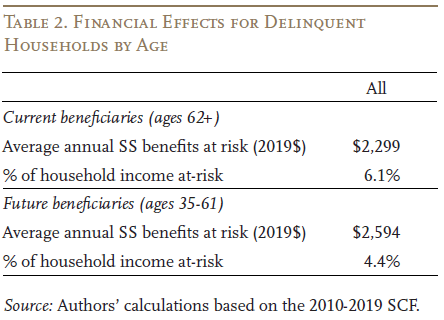

- The study finds that current and future retirees with delinquent debt could face a 4-6 percent drop in retirement income due to withheld benefits.

- But, the Biden administration’s plan would greatly reduce both debt and delinquency for future retirees and shrink racial inequality.

Introduction

Student debt has been rising dramatically over the past few decades, including among older adults. While the overall magnitude of student debt held by those ages 65 and over is not large, the debt burden in this group has been growing rapidly. At the same time, their default rates have also been rising. This trend is a particular concern because retirees with delinquent student loans can have part of their Social Security benefits withheld to pay for the loans. Such withholding may disproportionately harm disadvantaged groups as they are more likely to have delinquent loans.

This brief, based on a recent study, addresses two key questions: 1) What is the impact of student debt on current and future retirees’’ financial security? and 2) How would it change under the Biden administration’s recently proposed debt relief plan?1Wettstein and Liu (2022).

The discussion proceeds as follows. The first section provides background on older Americans with student debt and on the Biden administration plan. The second section describes the data and methodology for the analysis. The third section presents the results. The final section concludes that, while the financial consequences of student debt delinquency are relatively small for current Social Security beneficiaries, such debt is concentrated among disadvantaged groups and it may hit future beneficiaries harder. As expected, the proposed debt relief plan would substantially reduce student debt for all, while benefiting Black and Hispanic borrowers the most.

Background

Three trends in student debt have become apparent in recent years. First, a growing number of older Americans have outstanding student loans, with the rates of increase outpacing their younger counterparts.2For example, see Butrica and Karamcheva (2020), U.S. Board of Governors of the Federal Reserve System (2019), and U.S. Government Accountability Office (GAO) (2014, 2016). Older Americans hold federal student loans via multiple pathways. They could still be repaying loans for their own college education or mid- or late-career training; indeed, student loan terms can range up to 30 years. Alternatively, they may hold loans taken out for the education of their children or grandchildren through Parent PLUS loans. Second, delinquency rates are steadily increasing among student loan borrowers, surpassing all other types of consumer debt between 2012 and early 2020.3Delinquency rates have fallen dramatically since March 2020, mainly due to the pandemic-related loan payment pause that currently remains in effect. Lastly, racial disparities in student loans are large and growing, with debt holding and delinquency concentrated among Black borrowers.4Haughwout et al. (2019) and Looney and Lee (2018).

Prolonged delinquency can lead to partial withholding of Social Security benefits as payments towards federal student loans.5Delinquent retirees could have retirement benefits withheld, while delinquent younger borrowers could also be affected through withholding of disability benefits. In addition to withholding Social Security benefits, the Department of Education can also collect loan payments through administrative wage garnishment and offsets from federal tax refunds, both of which are outside the scope of this analysis. The withholding amount is the lesser of 15 percent of the total monthly benefit or the amount by which the benefit exceeds $750 per month. Despite the rising trend and widening racial gaps in student loan delinquency, limited evidence exists on the potential financial impact of these withheld benefits on borrowers.6U.S. GAO (2014, 2016) finds that the number of older student loan borrowers with their benefits withheld has grown rapidly since the 2000s.

The growth in student loan debt and delinquency for all age groups has sparked policy interest in loan relief. Most recently, the Biden administration announced a plan – currently on hold due to legal challenges – that features direct debt forgiveness along with other reforms.7The plan lays out major reforms of the existing income-driven repayment plan. In addition, the plan would expand eligibility of the Public Service Loan Forgiveness program to those who have not yet served 10 years in public service. Due to data limitations, this analysis only evaluates the effects of the direct debt forgiveness. Under this plan, up to $10,000 of student loan debt would be forgiven for loan holders with annual income below $125,000.8For couples, the annual income cutoff is $250,000. Pell Grant recipients, who received a government scholarship while in school due to significant financial need, can obtain an additional $10,000 of student debt forgiveness. Since Black and Hispanic students are more likely to receive Pell Grants, the direct debt forgiveness is expected to reduce the racial disparities in student loans. Yet much still remains unknown about the potential policy effects of this proposal.9Goss, Mangrum, and Scally (2022) find that, after accounting for the extra $10,000 of debt forgiveness for Pell Grant recipients, low-income neighborhoods are expected to experience the largest drop in student loan holding, balances, and delinquent debt balances.

Data and Methodology

The analysis draws from the Federal Reserve Board’s Survey of Consumer Finances (SCF), a triennial survey providing economic and financial data at the household level, including detailed information on student loans. The SCF offers the most comprehensive overview of household characteristics of student loan borrowers. This brief focuses on federal student loans – the majority of all student loans – whose borrowers could face withholding of Social Security benefits in case of delinquency.10Private student loans, due to their short history and limited access, remain less prevalent and account for less than 8 percent of all student loans borrowed as of 2021 (Amir, Teslow, and Borders 2022). Given the relatively small proportion of older respondents with student loans, our sample pools respondents from four waves of the SCF, spanning 2010-2019. The analysis focuses on two groups: 1) Social Security beneficiary households with a head or spouse over age 62; and 2) younger households, ages 35-61, who will claim retirement benefits in the future.

The first part of the analysis assesses student debt holding and debt balances for the two samples. Then, it evaluates the negative effect of failing to repay student loans on retirement security. Technically, Social Security benefit withholding occurs after a student loan has been delinquent for 425 days and the loan holder fails to restart repayment after being notified by the Department of Education.11See U.S. GAO (2016) for details of the administrative process. Due to data limitations, the analysis assumes benefit withholding for all delinquent loan holders.12The SCF had a major questionnaire update on student loans between 2013 and 2016. Our definition of delinquency remains relatively consistent over time – it covers all delinquent loan holders who are currently not making payments, excluding certain cases in which borrowers have deferments. See the full paper (Wettstein Liu 2022) for more details on the delinquency definition. After identifying which loan holders are at risk, the analysis calculates the maximum amount of benefits that could be withheld for individuals with the highest Social Security benefits in each household.13For future beneficiaries, the analysis projects Social Security benefits based on current earnings. Since the SCF does not differentiate student loans held by the household head and those held by the spouse (in married households), the analysis again evaluates the upper bound of the financial consequences of delinquency. In this case, the upper bound is found by reporting the maximum benefits at risk of being withheld in case of two beneficiaries in the same household.

The second part of the analysis provides a preliminary evaluation of the impact of the Biden administration’s debt relief plan on future Social Security beneficiaries.14The policy evaluation focuses on future Social Security beneficiaries because the incomes of current beneficiaries may not be representative of their incomes when the student loans were taken out. The focus is on what would have happened to student loan holding, balances, and delinquency rates if the direct debt forgiveness had been available to borrowers between 2010 and 2019. Specifically, the analysis cancels $10,000 in debt for borrowers who meet the income eligibility criterion; and it estimates which borrowers could have been Pell Grant recipients, who receive an additional $10,000 in debt forgiveness.

Data on Pell Grant receipt is not available in the SCF, but this indicator is important as about half of borrowers are expected to receive Pell Grants and the program directly helps students from low-income households. To this end, the analysis imputes Pell Grant status, assigning it to borrowers who have below-median household income, a simplifying assumption for a complex eligibility determination process.

Following this simplified approach, we estimate that about 56 percent of borrowers receive Pell Grants, which is on par with estimates from other sources.15 White House (2022) and Goss, Mangrum, and Scally (2022) both estimate Pell Grant rates of 60 percent among borrowers. The estimated share of Whites among Pell Grant recipients who are student borrowers is slightly higher in this analysis, while the share of Hispanics is lower compared to numbers published in National Center for Education Statistics (2019). Consequently, our approach to imputing Pell Grant status may lead to estimating a lower bound of the policy impacts on narrowing racial gaps.

Results

This section addresses our two key research concerns: the financial impacts of student debt under the status quo and the potential effects of the Biden administration plan. All results are for the household level.

Retiree Student Debt under Status Quo

The analysis starts by quantifying the prevalence and level of student debt among current and future Social Security beneficiaries, their delinquency rates, and racial disparities. It then estimates the potential financial consequences of benefit withholding.

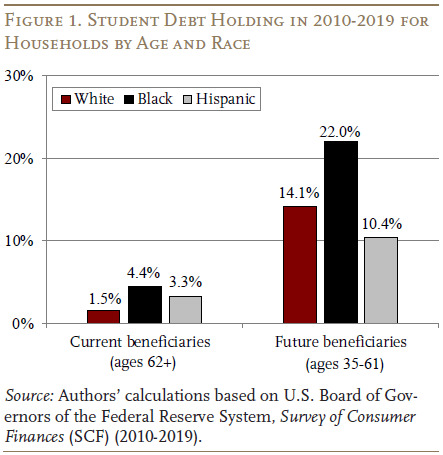

Debt Indicators. Only a small proportion of current beneficiaries – less than 5 percent in every race – have student loan debt, but this share is expected to be substantially higher for future beneficiaries (see Figure 1).

And both current and future Black beneficiaries are more likely to hold student debt than White ones16Other racial subgroups (e.g., Asian and other races), are not examined due to small SCF samples. In addition, debt-holding has been rising rapidly over time for most groups.17Data on time trends in debt holding and debt delinquency are available upon request.

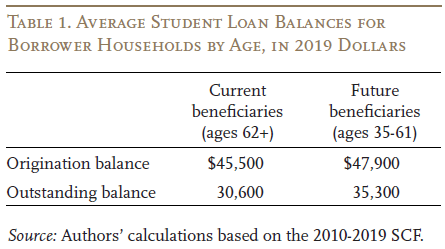

Furthermore, the size of the debt among those with loans is substantial. On average, student loans put borrowers more than $30,000 in debt, even for today’s older borrowers (see Table 1).

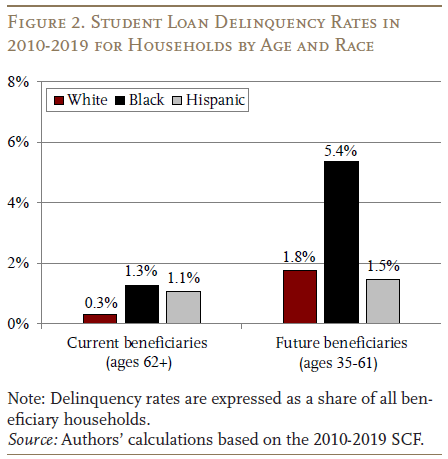

The story is similar for student loan delinquency. On the one hand, only a small share of current Social Security beneficiaries are not making loan payments and thus face the possibility of benefit withholding (see Figure 2). On the other hand, delinquency rates – which are expressed here as a share of the total beneficiary population – are estimated to be higher among future beneficiaries and concentrated among Black borrowers in both samples.

Financial Consequences of Loan Delinquency. On average, delinquent borrowers are estimated to face about a $2,500 reduction in annual Social Security benefits, representing 4-6 percent of household income (see Table 2). While these amounts are relatively small, for households that are just making ends meet, even a small decline in income can have significant consequences. Putting these numbers into context, the amount of withheld benefits could roughly pay off the average per capita credit card balance 18Calculations based on Federal Reserve Bank of New York (2022). Since delinquency rates are higher among younger borrowers, student loans may pose a bigger risk for this group’s future retirement security.

Impact of Biden Debt Relief Plan

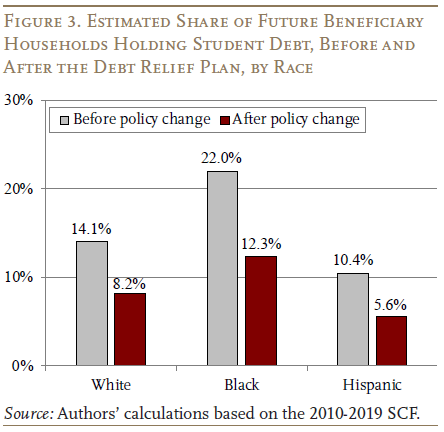

For future beneficiaries, the Biden administration’s debt relief plan would forgive an average of about $12,000 per borrower, with White borrowers a bit lower and Black borrowers somewhat higher. In terms of wiping out student debt completely, the plan would have the greatest impact on Black borrowers, reducing the share with debt by 10 percentage points – from 22 percent to 12 percent (see Figure 3 on the next page). In relative terms, both Black and Hispanic households would see their share of debt holders cut roughly in half.

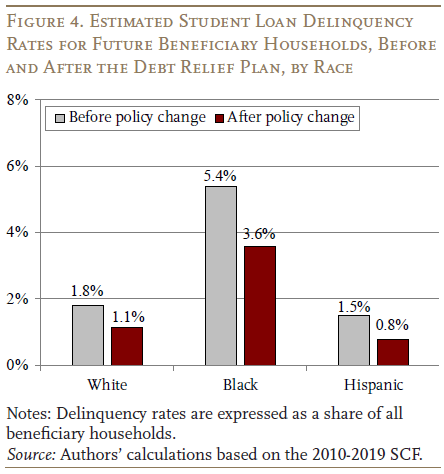

The policy effect on delinquency would also be substantial because many previously delinquent borrowers would receive complete debt forgiveness.19The analysis assumes that the drop in delinquency is limited to those who see their debt totally wiped out, which leads to a conservative estimate because it excludes those who end up with a lighter debt burden that could make it easier to avoid delinquency. Black borrowers are expected to see the largest decrease – 1.8 percentage points – in delinquency rates (see Figure 4). And Hispanic borrowers would experience the largest relative decrease, with the share of delinquent debt holders halved.

Conclusion

Very few current Social Security beneficiaries hold federal student loans, but future beneficiaries are much more likely to have such debt as they approach retirement, and their delinquency rates are higher. Borrowers in old age who are delinquent potentially face a 4-6 percent decline in household income due to benefit withholding. Overall, the growth in student loan delinquency suggests that, as today’s workers continue to move into retirement, student debt and the associated toll on retirement security may become more common among beneficiaries. Moreover, the concentration of delinquency among borrowers in racial minority groups suggests that student loan debt may become a source of racial inequality among beneficiaries.

The escalating prevalence of student debt has spurred calls for reform, such as the recent Biden administration proposal. Among future beneficiaries, our preliminary analysis suggests that Black and Hispanic borrowers would likely benefit most from the debt relief plan, receiving the highest amount of debt forgiveness and experiencing the largest drop in loan holding.

References

Amir, Elan, Jared Teslow, and Christopher Borders. 2022. “The MeasureOne Private Student Loan Report.” San Francisco, CA: MeasureOne.

Butrica, Barbara A. and Nadia S. Karamcheva. 2020. “Is Rising Household Debt Affecting Retirement Decisions?” Working Paper 13182. Bonn, Germany: IZA.

Federal Reserve Bank of New York. 2022. “Quarterly Report on Household Debt and Credit, August 2022.” New York, NY.

Goss, Jacob, Daniel Mangrum, and Joelle Scally. 2022. “Revisiting Federal Student Loan Forgiveness: An Update Based on the White House Plan.” New York, NY: Federal Reserve Bank of New York.

Haughwout, Andrew F., Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw. 2019. “Just Released: Racial Disparities in Student Loan Outcomes.” New York, NY: Federal Reserve Bank of New York.

Looney, Adam and Vivien Lee. 2018. “Parents Are Borrowing More and More to Send Their Kids to College – and Many Are Struggling to Repay.” Washington, DC: The Brookings Institution.

National Center for Education Statistics. 2019. “Trends in Pell Grant Receipt and the Characteristics of Pell Grant Recipients: Selected Years, 2003–04 to 2015–16.” NCES 2019-487. Washington, DC.

U.S. Board of Governors of the Federal Reserve System. Survey of Consumer Finances, 2010-2019. Washington, DC.

U.S. GAO. 2014. “Older Americans’ Inability to Repay Student Loans May Affect Financial Security of a Small Percentage of Retirees.” Washington, DC.

U.S. GAO. 2016. “Improvements to Program Design Could Better Assist Older Student Loan Borrowers with Obtaining Permitted Relief.” Washington, DC.

Wettstein, Gal and Siyan Liu. 2022. “What Is the Risk to OASI Benefits from Unpaid Student Loans?” Working Paper 2022-16. Chestnut Hill, MA: Center for Retirement Research at Boston College.

White House. 2022. “FACT SHEET: President Biden Announces Student Loan Relief for Borrowers Who Need It Most.” Washington, DC.

Endnotes

- 1Wettstein and Liu (2022).

- 2For example, see Butrica and Karamcheva (2020), U.S. Board of Governors of the Federal Reserve System (2019), and U.S. Government Accountability Office (GAO) (2014, 2016). Older Americans hold federal student loans via multiple pathways. They could still be repaying loans for their own college education or mid- or late-career training; indeed, student loan terms can range up to 30 years. Alternatively, they may hold loans taken out for the education of their children or grandchildren through Parent PLUS loans.

- 3Delinquency rates have fallen dramatically since March 2020, mainly due to the pandemic-related loan payment pause that currently remains in effect.

- 4Haughwout et al. (2019) and Looney and Lee (2018).

- 5Delinquent retirees could have retirement benefits withheld, while delinquent younger borrowers could also be affected through withholding of disability benefits. In addition to withholding Social Security benefits, the Department of Education can also collect loan payments through administrative wage garnishment and offsets from federal tax refunds, both of which are outside the scope of this analysis.

- 6U.S. GAO (2014, 2016) finds that the number of older student loan borrowers with their benefits withheld has grown rapidly since the 2000s.

- 7The plan lays out major reforms of the existing income-driven repayment plan. In addition, the plan would expand eligibility of the Public Service Loan Forgiveness program to those who have not yet served 10 years in public service. Due to data limitations, this analysis only evaluates the effects of the direct debt forgiveness.

- 8For couples, the annual income cutoff is $250,000.

- 9Goss, Mangrum, and Scally (2022) find that, after accounting for the extra $10,000 of debt forgiveness for Pell Grant recipients, low-income neighborhoods are expected to experience the largest drop in student loan holding, balances, and delinquent debt balances.

- 10Private student loans, due to their short history and limited access, remain less prevalent and account for less than 8 percent of all student loans borrowed as of 2021 (Amir, Teslow, and Borders 2022).

- 11See U.S. GAO (2016) for details of the administrative process.

- 12The SCF had a major questionnaire update on student loans between 2013 and 2016. Our definition of delinquency remains relatively consistent over time – it covers all delinquent loan holders who are currently not making payments, excluding certain cases in which borrowers have deferments. See the full paper (Wettstein Liu 2022) for more details on the delinquency definition.

- 13For future beneficiaries, the analysis projects Social Security benefits based on current earnings. Since the SCF does not differentiate student loans held by the household head and those held by the spouse (in married households), the analysis again evaluates the upper bound of the financial consequences of delinquency. In this case, the upper bound is found by reporting the maximum benefits at risk of being withheld in case of two beneficiaries in the same household.

- 14The policy evaluation focuses on future Social Security beneficiaries because the incomes of current beneficiaries may not be representative of their incomes when the student loans were taken out.

- 15White House (2022) and Goss, Mangrum, and Scally (2022) both estimate Pell Grant rates of 60 percent among borrowers. The estimated share of Whites among Pell Grant recipients who are student borrowers is slightly higher in this analysis, while the share of Hispanics is lower compared to numbers published in National Center for Education Statistics (2019). Consequently, our approach to imputing Pell Grant status may lead to estimating a lower bound of the policy impacts on narrowing racial gaps.

- 16Other racial subgroups (e.g., Asian and other races), are not examined due to small SCF samples.

- 17Data on time trends in debt holding and debt delinquency are available upon request.

- 18Calculations based on Federal Reserve Bank of New York (2022).

- 19The analysis assumes that the drop in delinquency is limited to those who see their debt totally wiped out, which leads to a conservative estimate because it excludes those who end up with a lighter debt burden that could make it easier to avoid delinquency.