Unpaid Student Loans Can Impact Social Security Benefits

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The withholding could be particularly serious for Black retirees.

My colleagues, Gal Wettstein and Siyan Liu, just completed a study using the Federal Reserve’s Survey of Consumer Finances to explore how delinquent student loans could lead to the withholding of Social Security benefits, which could disproportionately harm disadvantaged groups. Gal and Siyan also looked at the potential impact of President Biden’s debt relief proposal.

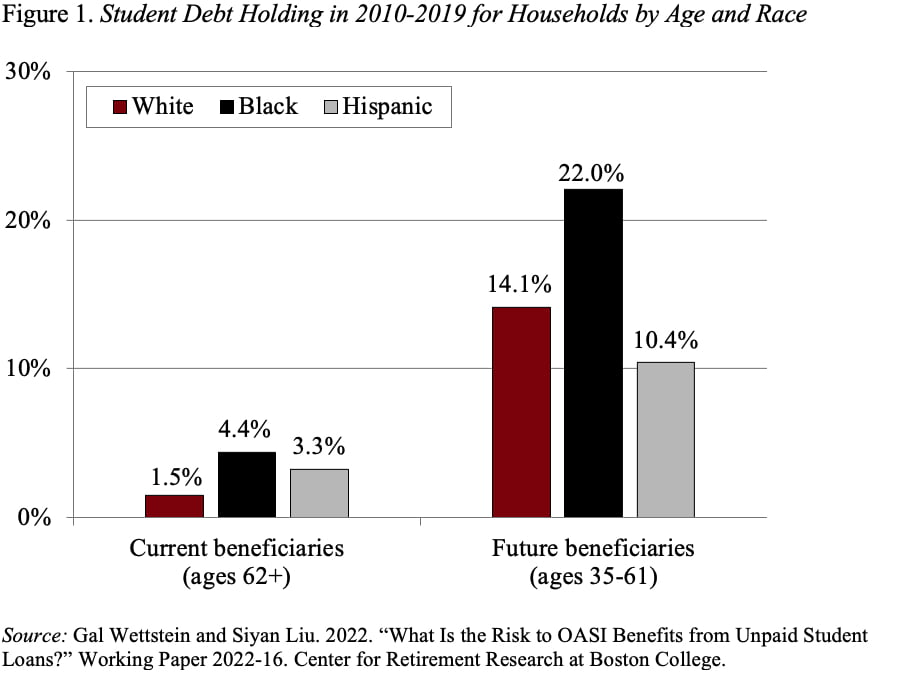

While the overall magnitude of student debt held by those 65+ is not large, the burden has been growing rapidly and is expected to be substantially higher for future beneficiaries (see Figure 1). And both current and future Black beneficiaries are more likely to hold student debt than white ones. The average loan balance, among all these borrowers, is more than $30,000.

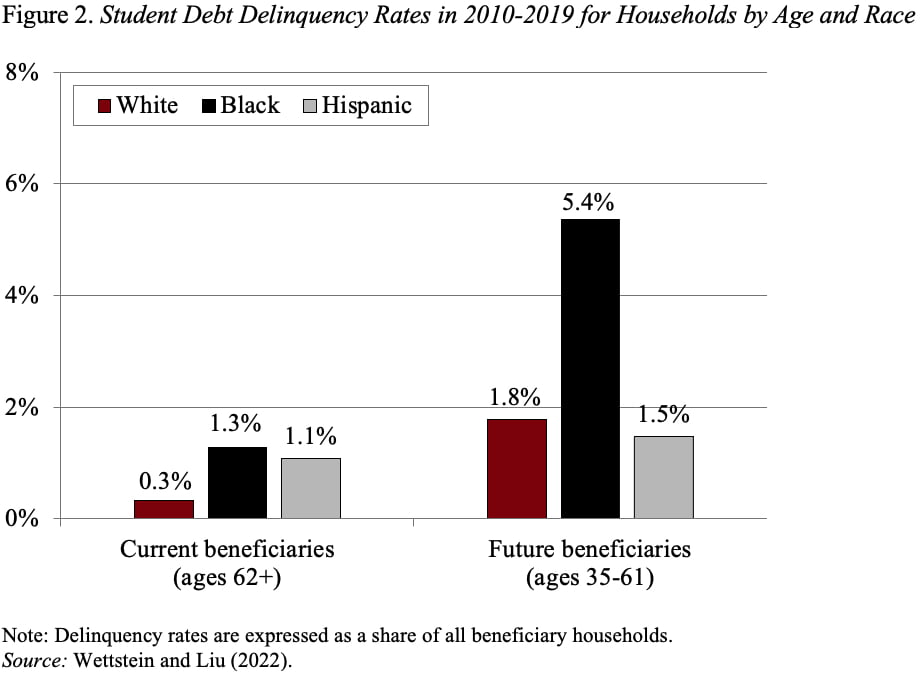

The story is similar for student loan delinquency. On the one hand, only a few current Social Security beneficiaries are not making loan payments and thus face the possibility of benefit withholding (see Figure 2). On the other hand, delinquency rates – which are expressed here as a share of the total beneficiary population – are estimated to be higher among future beneficiaries and concentrated among Black borrowers in both samples.

Technically, benefit offsets occur after a student loan has been delinquent for 425 days and the loan holder fails to restart repayment after being notified by the Department of Education. Due to data limitations, the authors assume benefit offsets for all delinquent loan holders. After identifying which loan holders are at risk, they then calculate the maximum amount of benefits that could be withheld for individuals with the highest Social Security benefits in each household.

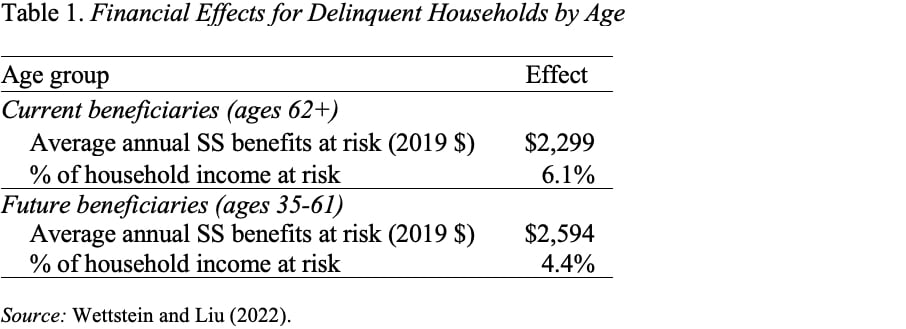

The results show that, on average, delinquent borrowers are expected to face about a $2,500 reduction in annual Social Security benefits, representing 4-6 percent of household income (see Table 1). Putting these numbers into context, the amount of withheld benefits could roughly pay off the average per capita credit card balance.

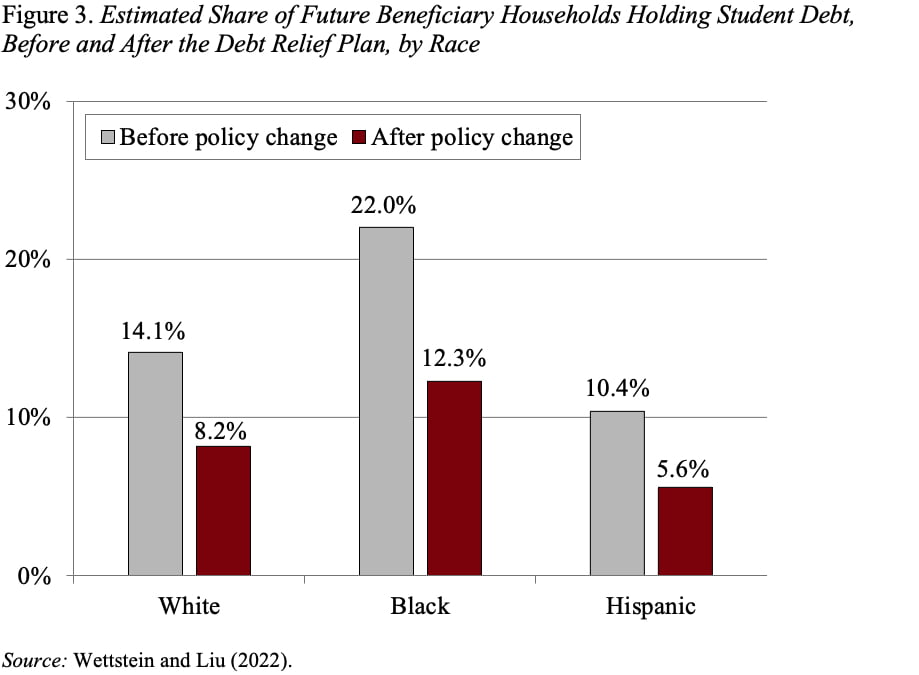

Of course, President Biden has put forth a plan for student debt relief. The analysis focuses on what would have happened to student loan holding, balances, and delinquency rates if the direct debt forgiveness had been available to borrowers between 2010 and 2019. Specifically, the authors cancel $10,000 in debt for borrowers who meet the income eligibility criterion; and they estimate which borrowers could have been Pell Grant recipients, who receive an additional $10,000 in debt forgiveness. In terms of wiping out student debt completely, the relief plan would have the greatest impact on Black borrowers, reducing the share with debt by 10 percentage points – from 22 percent to 12 percent (see Figure 3).

In short, student loans are not a phenomenon limited to the young. An increasing number of older people are also carrying a substantial debt burden. This burden could ultimately reduce the Social Security benefits of those who default. It is a problem that needs to be monitored.