Filter

Is It Truly Wheelchair Accessible? This App Has Answers

For people with disabilities that restrict their mobility, going out into the world is a harrowing, anxiety-producing experience. What if a subway stop with the icon denoting wheelchair accessibility doesn’t have the one thing essential to taking public transportation – an elevator? Will the sidewalk curb have a cut that allows an elderly person with a walker to get from the car into the building? Are there a couple steps up into the foyer? Restaurants are equipped with all sorts of obstacles too. Room to maneuver around the tables? Will my wheelchair arms fit under the table? Did the designer of the bathroom ramp and oversized stall fail to install grab bars? And what if I drink a lot of…

June 22, 2023

One in Four Households Unaware They Should Start Worrying About Retirement

Americans’ retirement outlook doesn’t change all that much: one standard measurement consistently shows that roughly half of working-age households may not be able to afford their current lifestyle after retiring. But do they even understand what condition their retirement finances are in? This is a critical question because perceptions can affect how much people will save for the future. The good news is that about 60 percent of working-age couples and single people are getting it right, the Center for Retirement Research finds. In other words, they predict, accurately, that they’re in trouble or that they’re in pretty good shape. But that leaves significant numbers who are either over- or underestimating how much money they will need to retir…

June 20, 2023

Lifelong Disadvantages Limit Equity for Older Black Homeowners

The historic discrimination that has limited the ability of older Black Americans to accumulate wealth has been present in every aspect of the housing market. They have paid a steep price. By the time they reached their mid-50s, they had $90,000 in home equity – or about $57,000 less than White homeowners – according to a new study of people who purchased houses between 1980 and 2000. The barriers to building up housing wealth started early for the Black homeowners. As young workers, they tended to earn less, and their parents usually had fewer resources to contribute to a down payment, a crucial factor in what they were able to buy. They also faced mortgage discrimination, and when they did…

June 15, 2023

Barriers to Advantage Plans’ Mental Health Coverage

Retirees tend to use mental health services less than the general population. On the bright side, people get happier as they age and may not need a therapist. However, treatment is also expensive, and retirees may be unaware that Medicare covers psychiatrists, psychologists, and in-patient and out-patient treatment. Retirees with Medicare Advantage insurance policies face another obstacle: ghost networks of mental health professionals that the insurer claims to cover. A new report by the Senate Finance Committee, based on a sampling of 12 Advantage plans in six states, determined that only about 20 percent of the people with these policies who seek services would be able to make an appointment because a majority of the plans’ lists of in-network therapists…

June 13, 2023

New Documentary an Intimate Portrait of Workers’ Trials

The seemingly random patterns in low-paid and middle-class workers’ struggles are assembled into a cohesive narrative supplied by people who let the camera in for an intimate look. A few top executives are thrown in to highlight the economy’s inequality, which lower-paid workers like Randi recognize as deeply unfair. Randi, a health care aide in rural Mississippi, explains in a new documentary that her job “pays little and works you to the bone.” Produced by Netflix, “Working: What We Do All Day,” is narrated by former President Barak Obama, who occasionally talks about his middle-class family, interviews some of the featured workers, and explains the economic shifts – globalization and the explosion in Wall Street wealth in the 1980s –…

June 8, 2023

Auto-enrollment is Highly Effective But Often More Costly

Automatically enrolling all new workers in an employer savings plan is a terrific way to push reluctant savers to prepare for a future in old age. They still have the option of withdrawing but usually stick with the plan once an employer signs them up. The preliminary results of a new study on Army personnel show just how effective auto-enrollment is. The strategy far outstripped other, less interventionist tactics that employers use to increase plan participation. In 2018, the U.S. Department of Defense implemented auto-enrollment in the federal Thrift Savings Plan for U.S. Army recruits and other new employees and started deducting 3 percent of their pay to deposit into their savings accounts. The plan participation rate for the new…

June 6, 2023

Expanded Child Tax Credit Helped Black Families

The drop in a key poverty measure to a historic low was an immediate result of Congress increasing the child tax credit in 2021 to make more families eligible and help them cope with COVID-19. The policy was particularly effective in reducing poverty in the Black community, according to researchers at Howard University, the University of Alabama, and the University of Wisconsin. Black Americans’ poverty rate has always been much higher than the White rate. But the researchers show that the effect of a more generous child tax credit was to dramatically reduce Black poverty all over the country. They overlaid the larger tax credit amounts and the expanded eligibility onto families’ 2019 financial data to estimate how many families…

June 1, 2023

Did Borrowers Spend More During Student Loan Freeze?

The pause in federal student loan payments during COVID has been a golden opportunity to chop down the debt. In March 2020, Congress stopped charging interest on the loans when it suspended the monthly payments. The moratorium is slated to continue through June. The zero-interest loan means inflation actually eroded the value of the debt, putting borrowers ahead of the game. And redirecting the payments toward the principal, rather than new interest accruals, reduces both the debt and future interest payments, since smaller loan balances mean less interest. This was a smart strategy for the workers who held onto their jobs during COVID and could afford it. But it is not what they have done, according to a new study. Instead,…

May 30, 2023

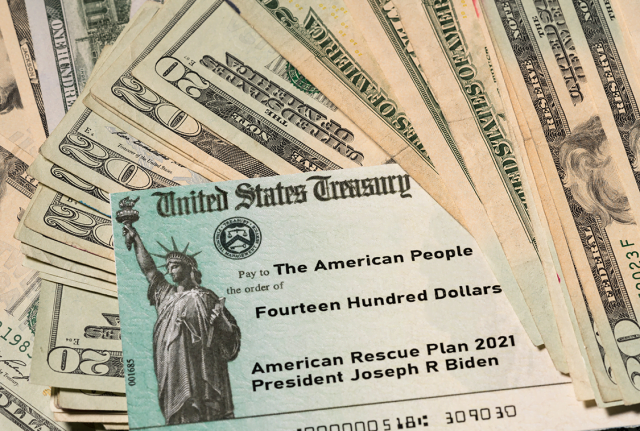

Federal Pandemic Relief Kept Low-wage Families Afloat

Now that COVID is fading, researchers looking back on the financial assistance passed by Congress during the pandemic are concluding that it helped millions of Americans get through a time of unprecedented distress. That the assistance would be adequate was not obvious in the midst of the economic turmoil in 2020 as COVID unfolded. But a year into the pandemic, Americans were feeling better off after the infusions of cash from federal relief checks and more generous benefits for laid-off workers that included an extra $600 per month and – for people with assets – soaring house and stock prices. When working-age adults were asked in 2021 how they perceived their finances, 36 percent said they would have troub…

May 25, 2023

Take Control When a Debt Collector Calls

Telephone customer service has become so automated that it can be extremely frustrating to resolve a problem. When it comes to bill collectors, the stakes are high. If the matter isn’t resolved, it can ruin your credit. In this video, Ana, a Cuban immigrant to Miami in the 1970s, hit a wall of silence after responding to a collection agency that claimed she owed $34,000 for a debt. (The video didn’t describe the nature of the debt.) If she didn’t pay, the agency threatened, it would put a lien on her property. But when Ana provided the debt collector with the documents to prove she’d already paid the debt, she got no response. The problem was finally resolved after s…

May 23, 2023

State Paid Leave: Help for Women Caring for Spouses

In the absence of a national paid family leave policy, 13 states have filled the breach with their own programs to partially compensate workers who take time off to care for an ill family member. In a new study examining the laws in three of these states – California, New Jersey, and New York – women are big beneficiaries of being able to take time off with financial support while they care for a spouse who has fallen ill. Nationwide, about 8 percent of working wives whose husbands develop a medical problem quit their jobs in response to the stress and strain of intensive caregiving duties. But in the researchers’ comparison of California, New Jersey and New York wit…

May 18, 2023

It Can be Tough to Stretch Social Security Over a Month

Social Security reduces poverty, stabilizes household finances, and can even support a beneficiary’s extended family. But drill down to a single month in the life of a low-income retiree or someone on Social Security disability, and a picture of hardship comes through. Researcher Madelaine L’Esperance at the University of Alabama found that financial problems build as the days pass since the last Social Security check. Over the course of a month, she said, recipients “were more likely to experience a financial shortfall as the pay cycle progressed.” The shortfalls occurred on the days when their spending, as reported in a daily diary, sharply reduced or depleted their cash on hand. Making ends meet can be very challenging for low-income peo…