U.S. Workers Lack Clarity on Financial Goals, Strategies

The minority of Americans who have a financial adviser say they feel pretty good about where they are. It’s everyone else who is largely dissatisfied with their finances.

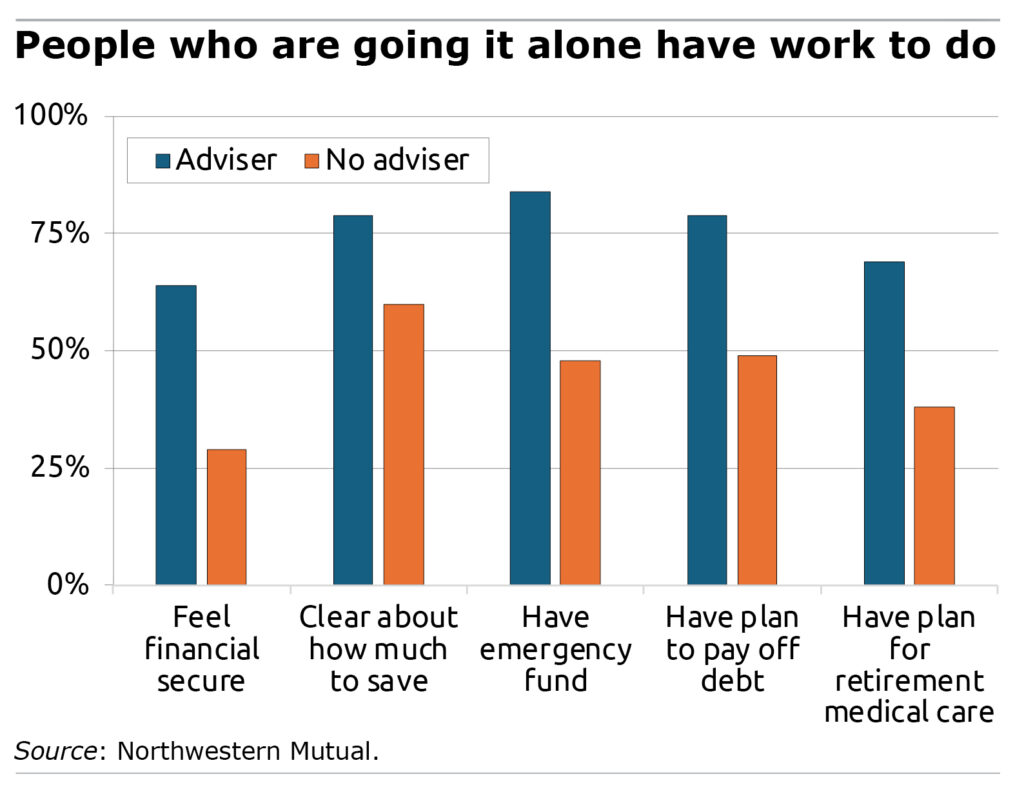

Among the workers and retirees who consult a financial adviser, two out of three describe themselves as financially secure, and the others are presumably working on it. Only one of three people who do not use an adviser are feeling secure, according to Northwestern Mutual’s January survey of more than 4,500 adults over age 18.

About 80 percent of those with an adviser also have a plan for how they will pay off debt, whether members of Gen Y and Gen Z with student loans or baby boomers with a mortgage. Only half without an adviser do.

The point in making these contrasts is not to advocate for hiring an adviser but to highlight the fact that too many Americans are flailing and are unclear about what they need to do to prepare for retirement.

Now that private-sector pensions have largely fallen by the wayside, saving is critical. Retirees use it to supplement their Social Security, which replaces about 40 percent of an average retiring 65-year-old’s wages today. But four out of every ten U.S. workers are not on track with their savings to ensure they will be able to maintain their current lifestyles when they retire.

And the number of people in trouble would be a lot higher if the housing market had not been on an upward trajectory for more than a decade. Home equity, like a 401(k), counts as a form of retirement wealth. But in practice, it’s not much use to retirees because they don’t usually tap it to support their living standards.

A large majority of the people in Northwestern’s survey who employ advisers said they are clear about the tradeoff between spending now and saving for later. Working with an adviser provides the “clarity that people don’t have on their own,” argues Hanna Grichanik, a financial adviser with Northwestern Mutual.

Another example is an emergency fund. Grichanik says it’s just as important for a retiree to have one as a worker. But their reasons differ somewhat. Workers who have an emergency fund for unexpected expenses don’t have to deplete the money they’re saving for a retirement still many years away. Retirees also need cash for the unexpected. If they have an emergency fund, they can better time their regular withdrawals from retirement savings. They “don’t have to take money out [of savings] when the market is down. It’s the same reason people don’t sell their home at a depressed price,” she said.

Whether someone chooses to hire an adviser or not, planning is key. “Intention leads to better results,” Grichanik said. The issues Northwestern asks about in its survey – saving for retirement, an emergency fund, a plan to pay off debt – are a guide to what needs to be done to feel financially secure. It takes work.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

From the survey: “They also have saved twice as much money for retirement than those who do not have an advisor.” Which pretty much accounts for all of the difference, notwithstanding the grammar.

What you didn’t say, but perhaps should have, is that many advisers won’t work with you unless you have a certain income or net worth.