What Resources Do 65-Year-Olds Have to Cover Long-Term Care in Retirement?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Only 21 percent could fund “high intensity” care for 5 years or more.

The second brief in our series on long-term care brings us one step closer to understanding the share of 65-year-olds that will be able to meet their long-term care needs in retirement.

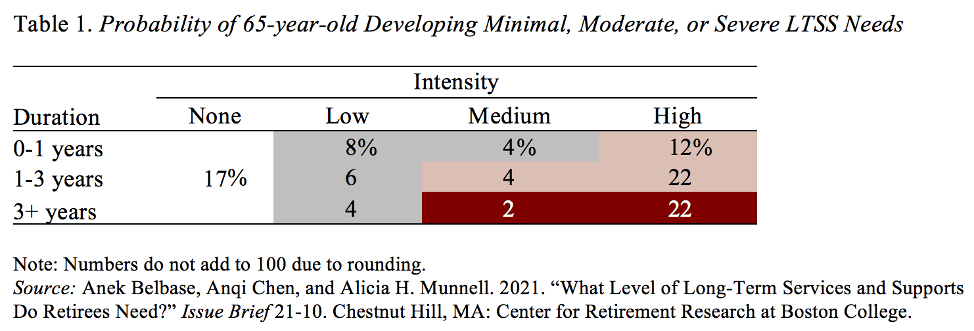

Just to refresh your memory – in case you don’t think about this every day! – the first brief examined the odds of a 65-year-old needing minimal, moderate, and severe levels of long-term care. The level of care took into account both the intensity – hours per week – and the duration – less than a year, 1-3 years, and 3 years or more. The results show that roughly one-fifth of 65-year-olds will die without ever requiring care, and about one-quarter will have severe needs (see white and red shading in Table 1). In between these two extremes, 22 percent will experience minimal needs (gray shading) and 38 percent will experience moderate needs (pink shading).

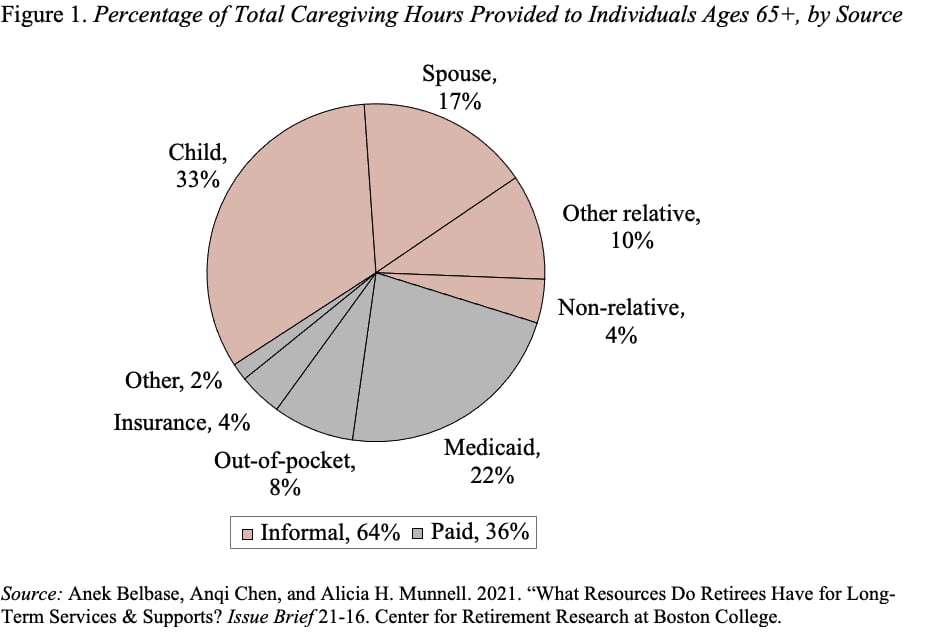

The second brief explores the extent to which retirees’ financial and non-financial resources together could meet different levels of care. Households can provide for these care needs in two ways. The more common way is unpaid informal care provided by family members. The less common way is paid formal care, financed either out-of-pocket or through long-term-care insurance or Medicaid. As shown in Figure 1, the bulk of long-term care comes from family members.

The goal in this second brief is to calculate the percentage of individuals at age 65 who have the family and financial resources to cover the cost of minimal, moderate, and severe long-term care needs, if they were to develop such needs. The focus is the hours of care that individuals could access through their own resources. The support provided by Medicaid, which is important for those with little income and assets, will be deferred to the third brief.

To determine the total number of hours of care needed, we multiply the median annual hours for low, medium, and high intensity levels by the duration for which the care is required. For this calculation, we use the durations of 1 year for minimal care, 3 years for moderate care, and 5 years for severe care.

On the resource side, we make two adjustments. First, we allow individuals to retain 20 percent of their financial resources for emergencies. Second, we reduce the hours of informal care available by taking into account the emotional and physical health of the caregivers.

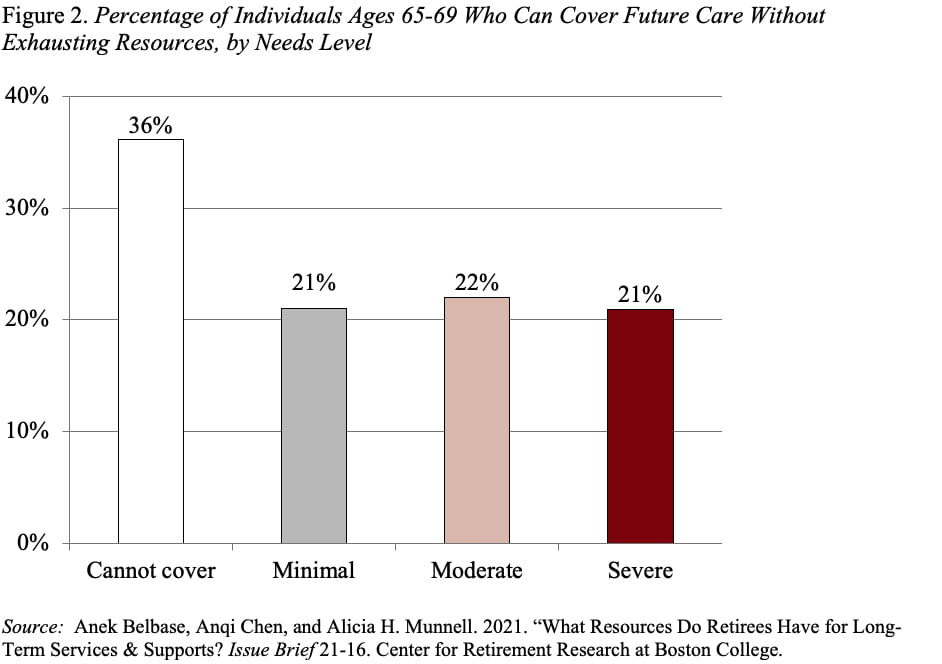

With these adjustments, the results show that 21 percent of retirees can cover severe care needs for at least five years using income, financial assets, and informal caregivers. At the other extreme, 36 percent of individuals cannot afford even minimal care needs. The remaining are divided equally between those who can afford minimal care and those who can cover moderate care (see Figure 2).

The big question is whether the people who will need help are the same ones who have the resources. To answer that question, the third – and final – brief will compare people’s likely care needs with their available resources. This process will identify the individuals and groups who may end up with unmet needs and describe the extent to which Medicaid fills that gap.