Who Will Have Unmet Long-Term Care Needs?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The good news is that most – albeit not all – care needs will be met by a combination of family care, financial resources, and Medicaid

We have just completed the third study in our three-part series on the needs and resources available for long-term care. This issue is really important because many late-career workers and retirees are very worried about the possibility of needing costly care later in life. Fear of dependency may make them reluctant to spend their 401(k) balances, depriving themselves of necessities as they age.

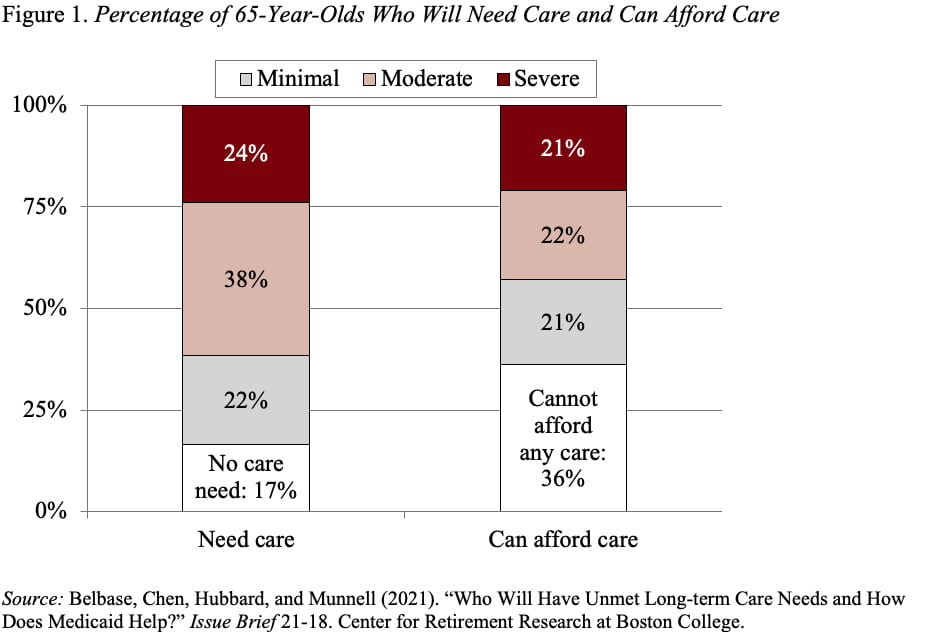

To recap. The first study examined the odds of a 65-year-old developing minimal, moderate, and severe needs, considering both the intensity and duration of the required care. The results show that roughly one-fifth of 65-year-olds never require long-term care and about one-quarter will have severe needs, with the rest falling somewhere in between (see first stacked bar in Figure 1).

The second study estimated the share of retirees who have the resources – either informal care from family or financial means – to cover any potential minimal, moderate, or severe care needs. The results determined that more than one-third of retirees will not have the resources for even the most minimal level of care, while one-fifth can afford care for severe needs if necessary (see second stacked bar in Figure 1).

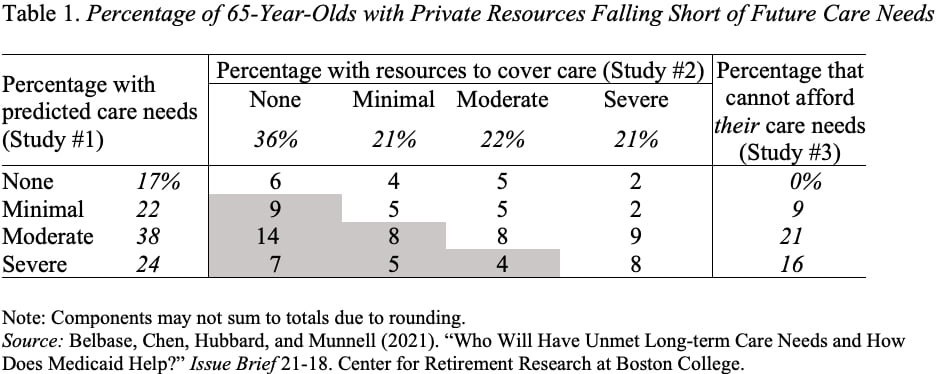

The final study combines the findings from the two earlier analyses to determine the share of individuals projected to have inadequate resources for their specific care needs. The left-hand column in Table 1 shows the distribution of 65-year-olds by their predicted lifetime maximum level of care needs (Study #1). The top-most row shows the distribution of 65-year-olds based on the highest level of care they can afford using their private resources (Study #2). The last column shows the percentage of individuals with inadequate resources to cover their specific level of care – the sum of the shaded numbers in each row (Study #3).

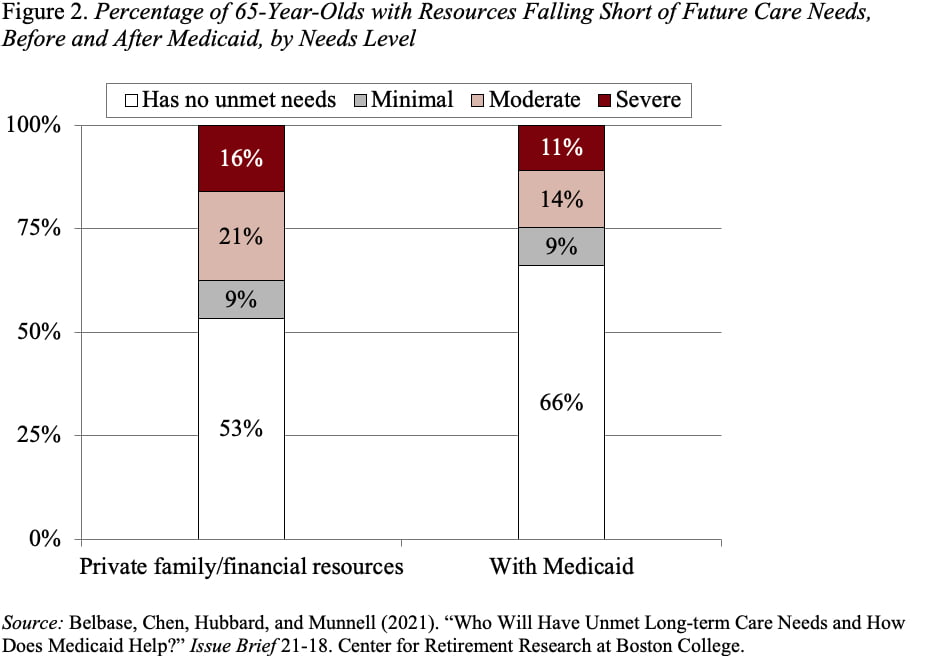

Overall, the results show that about 60 percent of those with moderate or severe needs will not have the family or financial resources to meet those needs. Fortunately, Medicaid – a joint federal-state program – offers some support for these individuals (see Figure 2). Without Medicaid, 16 percent of 65-year-olds will have severe care needs that they will not be able to fully cover using private resources. After accounting for Medicaid (for both those who qualify directly and those who spend down), this share declines to 11 percent. Similarly, 21 percent of 65-year-olds will have moderate care needs that they cannot fully afford; however, Medicaid reduces this share to 14 percent.

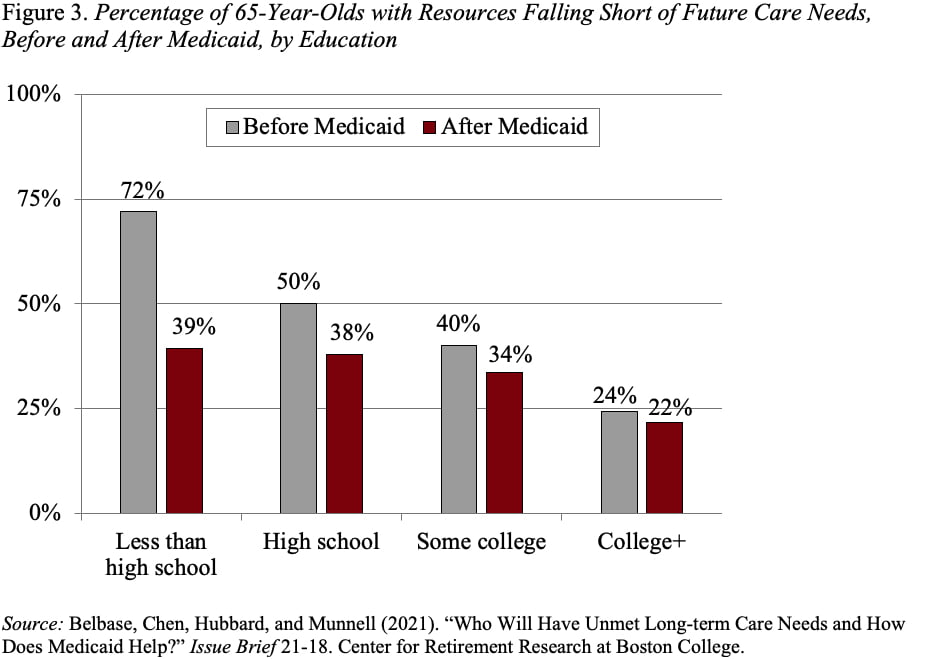

Not surprisingly, Medicaid helps those with fewer resources the most. For those with less than a high school education, Medicaid cuts the percentage falling short almost in half, while for those with college degrees – many of whom will not qualify for benefits – it has only a slight effect (see Figure 3).

The bottom line is that when Medicaid is added to family and financial resources, most Americans can meet most of their needs for long-term care. 401(k) participants should be somewhat more sanguine than they are about using their balances to support their consumption in retirement.